BOSS Zhipin 直聘

Hold it for the next 10 years

Tip: use the outline bar on the left to jump around and explore this post more easily.

Introduction

Boss Zhipin is the largest online recruiting platform in China. Together with ByteDance and PDD, they are the three Chinese companies that built their products and business models upon feed recommendations. In my view, replacing search with recommendation is the greatest innovation and contribution by the second generation of Chinese tech entrepreneurs. As a testament to the power of this disruptive model, all three companies not rose and reshaped their industries’ competitive landscapes in just around five years.

From an investor’s perspective, Bytedance is out of the picture as it stays private. Among the remaining two, I find it interesting to ask myself: which one would I choose to hold for the next 10 years? My pick is BZ, hands down—both for its competitive strength and growth potential. Even better, BZ is still relatively unknown to many investors compared with its more prominent peers. Here’s why I favor BZ.

Better competitive position

First of all, recommendation is much more needed in recruiting than e-commerce. As I will explain in the main text, recruiting and job searching is a matching problem where search barely works. This is not entirely true for e-commerce - the need of a shopping experience or high-quality products will always be there. Therefore, recommendation feed only helps PDD to establish a differentiation (via the online Costco model), but it enables BZ to truly disrupt online recruiting. This is the fundamental reason why BZ is replacing its predecessors, while PDD is co-existing with them.

Investors should look for widening moat, not just wide moat. One key factor in a business’s ability to widen its moat is how well it can withstand cutthroat competition—a particularly important question when investing in China. Unfortunately, PDD operates in a world where cash-burning subsidies, discounts, and aggressive ad campaigns are the norm. As I’ll explain later, those tactics, common in e-commerce, food delivery, and ride-sharing, barely work in online recruiting. That’s why I believe BZ’s moat is far more robust than PDD’s.

Higher ceiling

Putting these two points together, I’m confident that BZ will continue dominating and capturing more market share—still under 10% today. In contrast, PDD’s growth is limited by the overall industry growth.1 After all, how confident can anyone be that PDD will take a significant chunk of market share from BABA, JD, or Douyin?

BZ’s founder, Peng Zhao, once said he sees Recruit Holdings as the ceiling for this business. Today, Recruit’s market cap is around $90B, achieved through diversification (staffing, etc.) and overseas acquisitions. I think BZ, however, doesn’t even need that kind of expansion to reach a $100B valuation—a 10x growth from here—because China’s employee base is roughly 8 times larger than Japan’s.

Here is the math: China’s GDP is around $19T, with more than half going to employee compensation.2 If enterprises allocate just 1% of that $8T to online recruitment platforms, the industry TAM would be $80B. If BZ captures a 30% share and maintains a 50% margin, that implies $12B in profits. Applying a 10x multiple gives a $120B valuation.

A founder like no other

The real source of BZ’s widening moat lies in its culture—and in the founder who shaped. It’s no exaggeration to say that this report would not exist without my deep admiration for Peng Zhao. His story - built BZ with zero tech background - is legendary. The combination of his deep business insight, management skills, and exceptional integrity are truly rare.

I’ve observed that many exceptional managers aren’t always shareholder-friendly. And people often make exceptional effort to accommodate them. With Peng Zhao, you don’t have to worry about that. He is always open and transparent in earning calls, and he believes that shareholder return is the right thing to do. I’ve scattered his quotes throughout the report so you can get a sense of his character and brilliance. Here is the first one:

“… we have long been insist on shareholder return, which is a basic ethic for the company. Confidence from both our employee and our shareholders come from real monetary returns."

— Peng Zhao, 2024 Q2

Thesis Summary

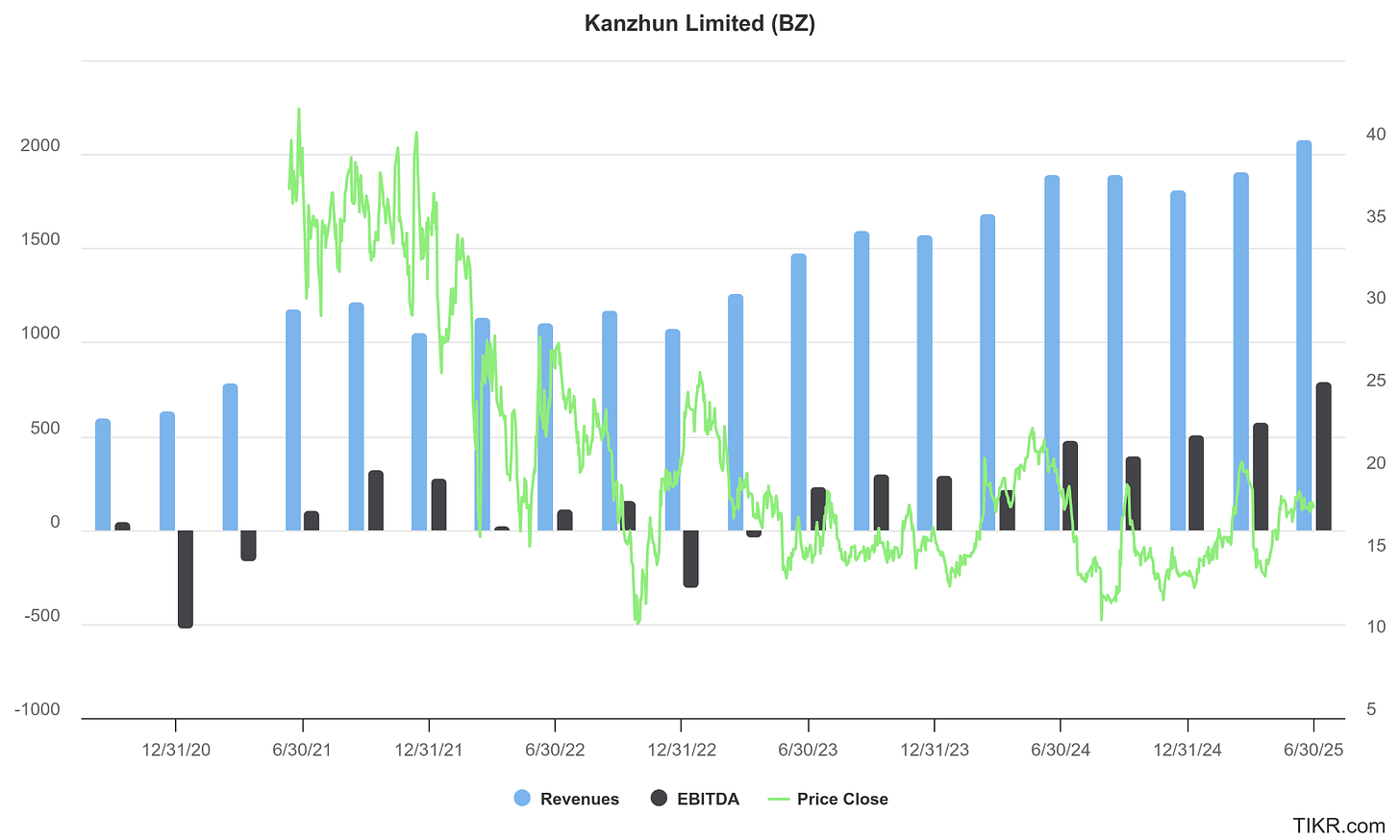

BZ’s stock has been stuck below $25 since 2022, even as the company kept posting record revenue and profit. It’s now back at the highs again — let’s see if it can finally break out this time.

My valuation puts BZ at $35–$57 per ADS, depending on the assumptions in my bear, base, and bull cases. Even after an 80% rally since April, the stock still trades about 30% below my bear case estimate.

Key Thesis Drivers

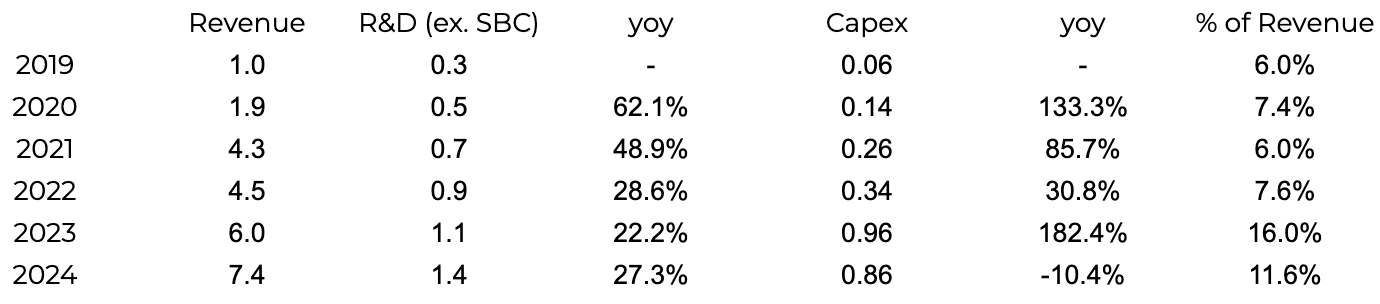

My five-year cash flow projection is based on the continued execution of BZ’s current strategy—prioritizing user growth while remaining conservative on monetization. The key points are outlined below and discussed in detail later.

BZ disrupted online recruiting with its MDD model (Mobile, Data, Direct Recruit), addressing the pain points of the traditional job-board approach. This new model delivers higher matching efficiency and opens access to the massive, previously underserved market of SMEs and blue-collar workers. Together, these factors enable BZ to build a scalable two-sided network with much greater growth potential than its predecessors’.

BZ’s moat lies in the fact that its model can’t be easily replicated, as competitors operate under a very different culture. BZ is a tech-driven platform focused on serving job seekers, while 51Jobs and Zhaopin has been sales-driven businesses serving to large enterprises.

BZ also enjoys the privilege of widening its moat with little resistance. Cash-burning marketing tactics is ineffective in this space, as recruiting is inelastic, low frequency behaviour. You can’t pay people to change jobs or subside companies to create hires.User growth will remain the main driver for BZ over the next five years. I project the number of verified enterprise users (along with job seekers) to grow at 15% annually, a conservative assumption compared with the 20%–30% growth seen over the past three years. Under this assumtpion, enterprises on BZ would represent only 42% of all employed companies in 2029.

Paying ratio is closely linked to economic conditions and the supply-demand balance in the job market. I assume it will recover by 1% per year starting in 2025, 2026, and 2027 under my bear, base, and bull cases, respectively. Although ARPPU remains relatively low, management is unlikely to push it aggressively in the near term, so I assume it stays largely flat over the next five years.BZ enjoys strong operating leverage. Its current Sales & Marketing spend is already twice that of its competitors, yet represents the smallest percentage of revenue. I assume R&D expense and capex will decline by 10% over the next two years due to reduced investment in LLM. I’m very pleased with management’s measured and disciplined approach to AI. Under my base-case projection, EBIT margin (excluding SBC) reaches 56% by 2029.

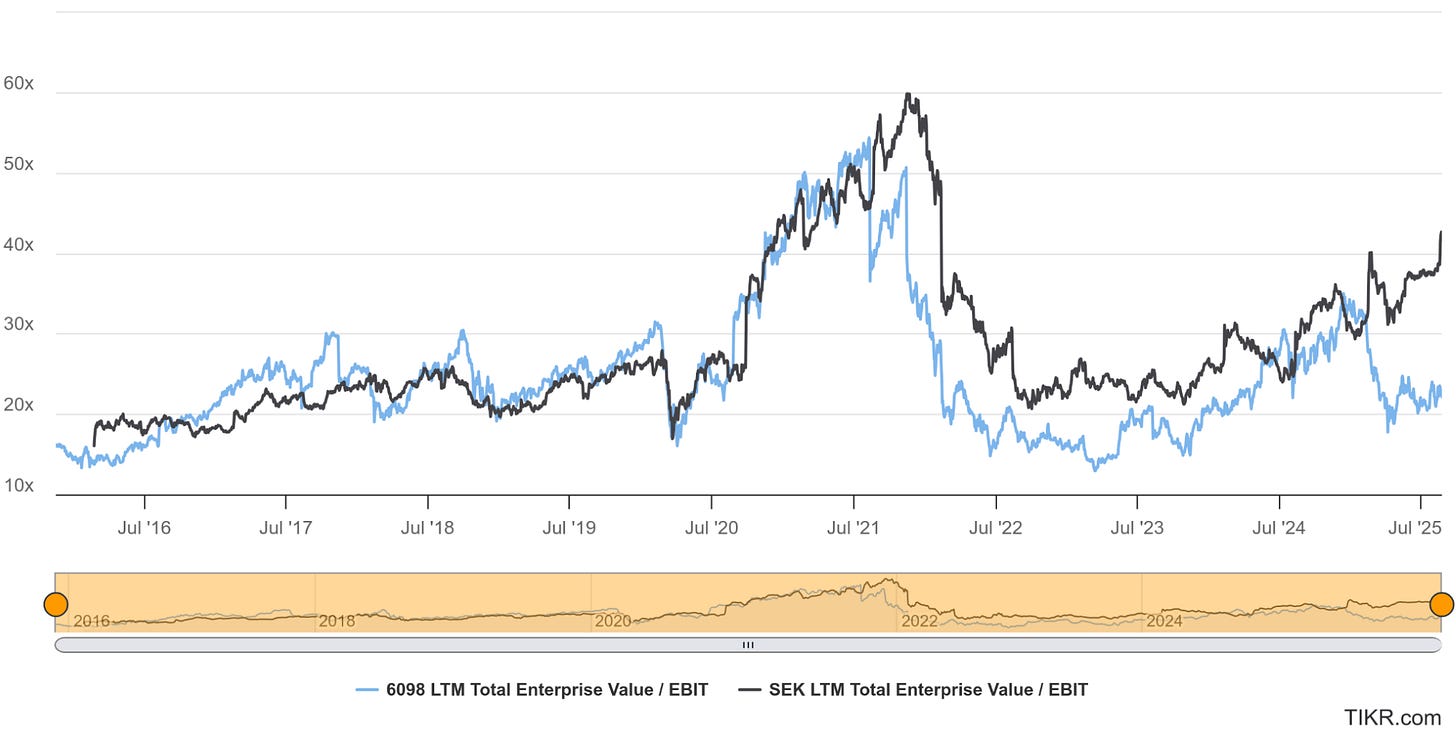

A 20% paying ratio and around ¥1,000 ARPPU leave plenty of room for further monetization beyond 2029, making my bear-case exit multiple highly unlikely. For comparison, companies like Recruit and especially SEEK have historically traded between 20x and 30x EV/EBIT. BZ has also started experimenting with overseas expansion, though it’s too early to draw conclusions. I assume an EV/2029 EBIT of 15x, 20x, and 25x for my bear, base, and bull cases, respectively.

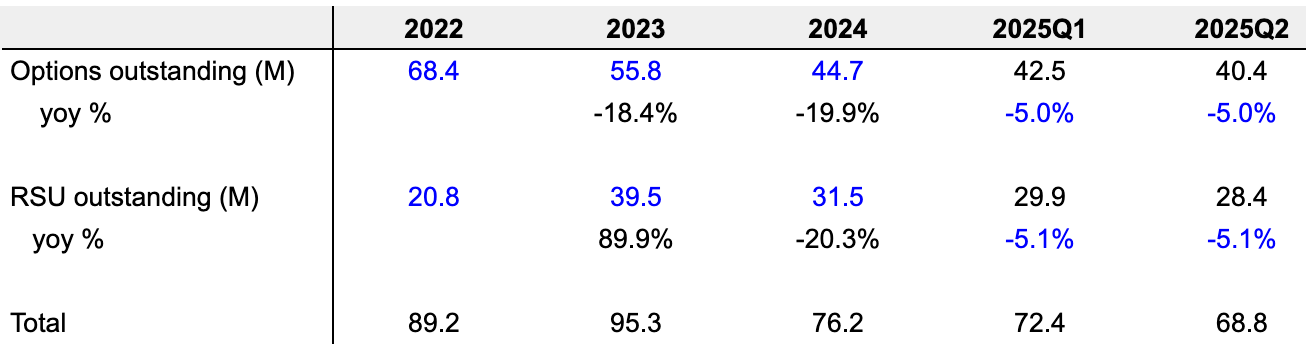

Outstanding options and RSUs are fully included in my calculation of intrinsic value per share. I also assume a 2% annual SBC in projecting owner’s earnings. No stock buybacks are factored in, making my valuation conservative given BZ’s generous buyback activity in recent years.

Catalysts

Share buybacks. BZ spent ¥2.67B on buybacks over the past three years, and management just announced a new $200M plan.

Declining SBC: High share-based compensation following the IPO and dual listing has dragged down BZ’s bottom line. SBC dropped 15% in 2025 Q1 and 24% in Q2. As SBC continues to decline, BZ’s true earning power will become clearer.

Recovery of China’s economy: A stronger economy would support both the paying ratio and ARPPU.

The Rising of Boss Zhipin

From day one, this industry never had to worry about its revenue model. But by the thirteenth year, around 2010, it had reached a point where making a modest profit was easy and enough to get by, yet the chance to make real money was gone. So the question became: how do you transform the industry? How do you make world-class investments, attract top talent, stay at the forefront of internet products and technology, and offer services that truly belong to this new era? Making that decision was anything but easy.

— Peng Zhao

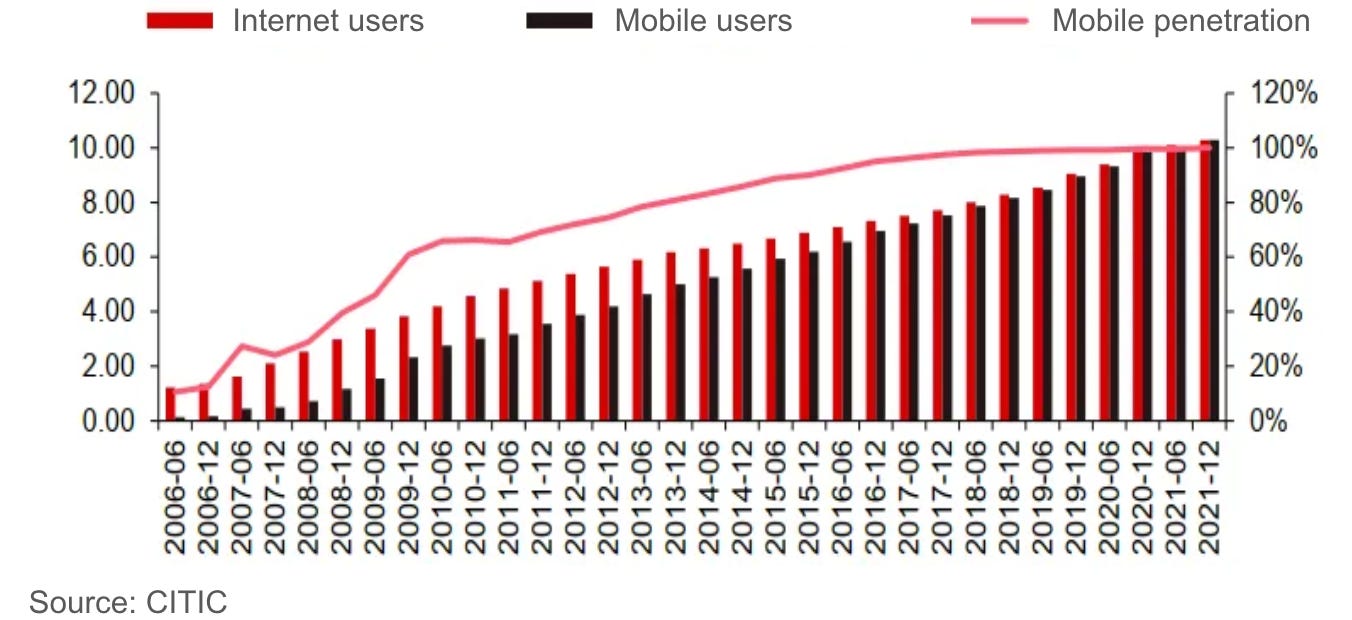

The recruitment industry was one of the earliest to move online—well ahead of sectors like food delivery, tourism, education, and payments. Platforms such as Zhaopin and 51Job, founded as early as 1997, were pioneers in this space. The online recruiting businesses was lucrative since day one, while other internet companies were still exploring profitable models. 51Job went IPO in the US in 2004, became the best performing Chinese stock that year.

However, as Horace said, ‘many shall fall that now are in honour’. In 2021, Wechat was released — officially kicked off the generational wave of mobile over the next decade. Incumbents who active embraced the mobile trend survived and thrived. Jack Ma’s command All-in Mobile in 2013 was legendary.

Unfortunately, that’s not the case for 51Jobs and Zhipin. They got too comfortable with their lucrative business and are numb to the new, disruptive trend. Then BZ was born and released their mobile app in 2014. Same year, Liepin, who started as a headcount companies in 2006, release their mobile app.

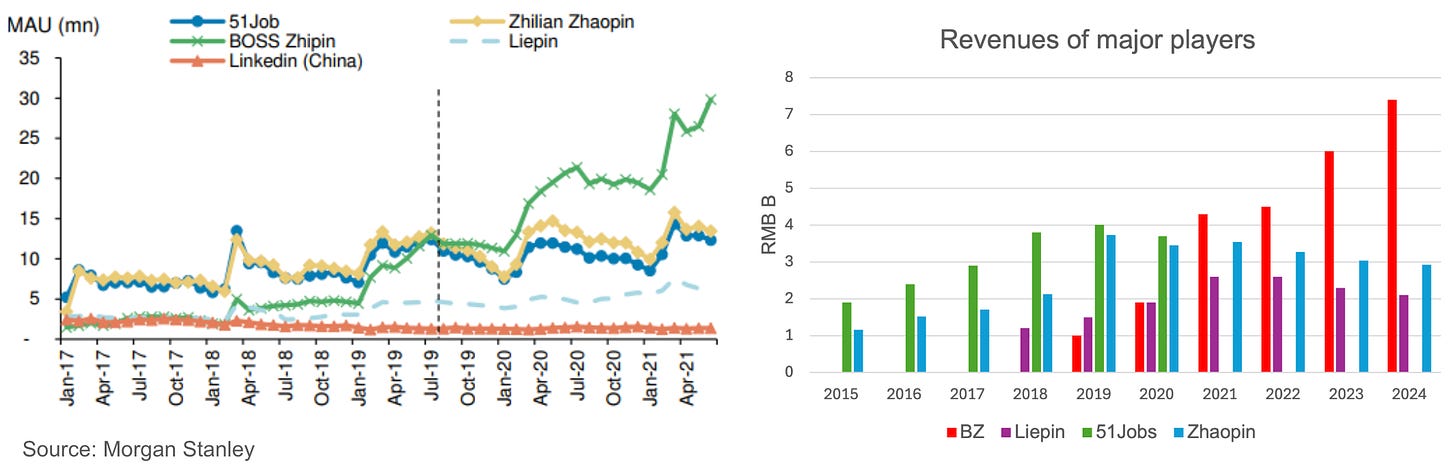

Things changed rapidly since then, BZ became the largest online recruiting platform in 2019, measured by any metric, and is growing at an exponential rate. Zhaopin went private in 2017, followed by 51Job in 2020.

However, the issues of traditional online recruiting platforms go far beyond the need of a mobile app. The pain points run at the deep level of their business model.

Problems of the Job Board Model

I more or less understand the pain points in recruitment—I know that search doesn't really work.

— Peng Zhao

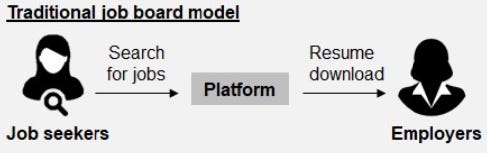

Tradition recruiting platforms run a job board model, where job seekers search for job posts, submit resumes and waiting for contact from interested employers. To some degree, the model host a long list for users on each side to search. As I will explain in detail, this model suffers from low matching efficiency, poor user experience, and large underserved market. In the language of network effect, this leads to clogged flywheel and low node number, preventing the network from reaching critical mass and exponential growth.

Uneven traffic distribution

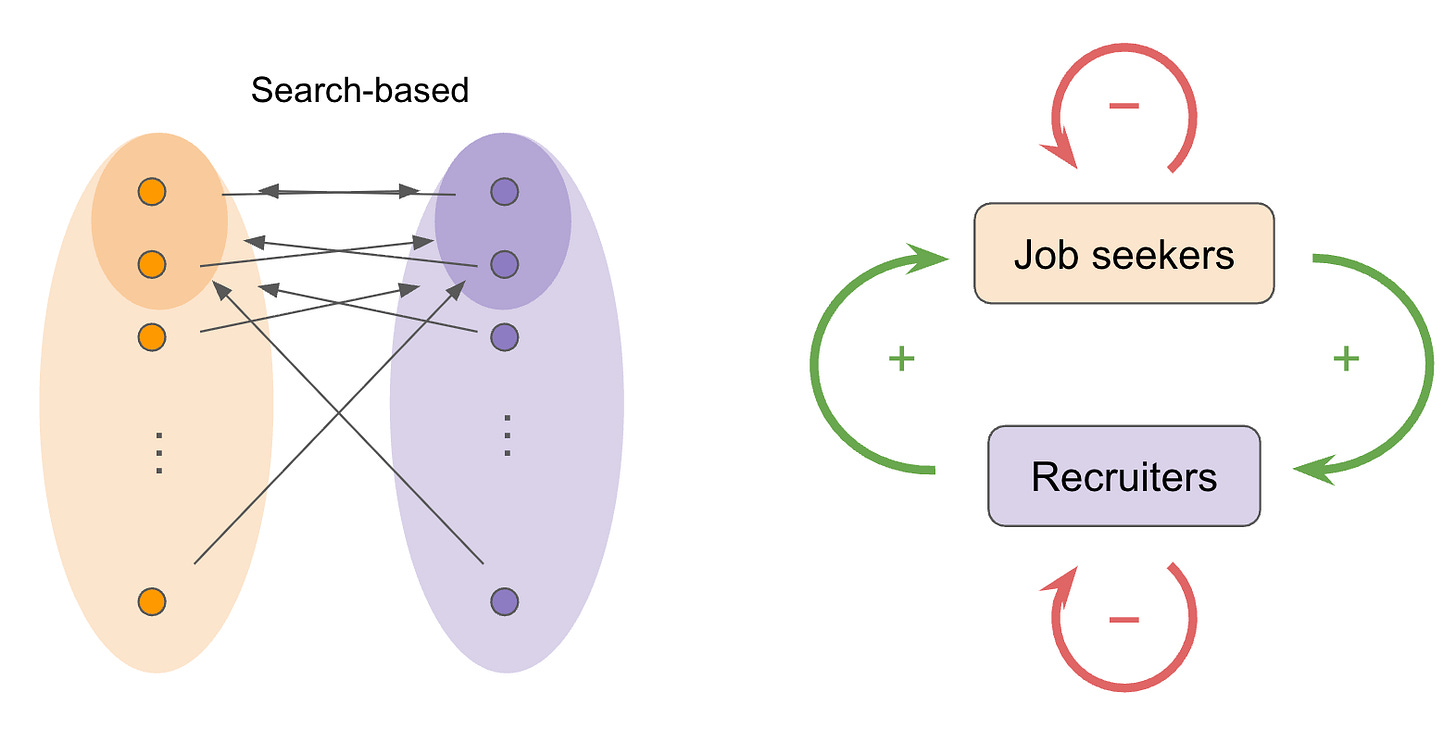

Fundamentally, recruiting is a one-to-one matching problem, which means there are always internal competitions between job seekers and recruiters. Competitions mean negative direct negative network effect on both sides — opposite of ‘the more the merrier’. Competitions also leads to traffic concentration toward top players on both sides (large companies and strong candidates).

Taking the recruiter side as an example. It’s not difficult to understand how the following leads to traffic concentration:

Submitting a resume costs job seekers nothing, so most will apply to well-known companies regardless of whether they are actually competitive candidates.

Since job descriptions tend to be generic and lack differentiation, small companies, even if ranked highly, are often ignored in favor of large, well-known enterprises.

Interestingly, e-commerce platforms largely free from this problem. There is no competitions among buyers, as each seller can, in theory, absorb infinite demands. There are competitions among sellers, however, it’s only a problem for smaller sellers. The traffic concentration is only welcomed by top players. Actually, such phenomenon attributes greatly to PDD’s early success.

Back to recruiting, the competitions and uneven traffic distribution lead to terrible user experience—large companies complain about being flooded with unqualified resumes, smaller companies receive little to no interest despite paying for exposure, and most job seekers never hear back after applying. It's hard to think of another internet product with such a poor user experience.

Largest segment remain underserved

A resume-centric model is inherently unfriendly to both small and medium-sized enterprises (SMEs) and blue-collar job seekers. On the recruiter side, this model works best for large companies with dedicated HR teams to screen resumes. SMEs typically rely on managers to hire directly. On the job seekers side, blue-collars with low education levels have little to write about their previous experiences. Blue-collar roles are often high-turnover and easily substitutable, requiring fast communication and decision making. The traditional process of writing and screening resumes is simply too slow for such needs.

Why does this matter? 99% of China’s enterprises are SMEs and blue-collar workers accounts for around 50% of job seekers. In other words, the resume-centred model fails to serve the very groups that make up the bulk of the job market in China. Without enough number of nodes on both sides, platforms before BZ struggle to reach the critical mass needed for strong network effects.

How BZ reinvented Online Recruiting

I understand that the essence lies in the boss directly finding the right person. I don’t know how well this approach will work, and I don’t know when I’ll fully figure it out, but I’m certain that search won’t work.

— Peng Zhao

It's no exaggeration to say that Boss Zhipin was created precisely to solve the industry pain points I discussed earlier. Its answer—embodied in its business model—rests on three foundational pillars:

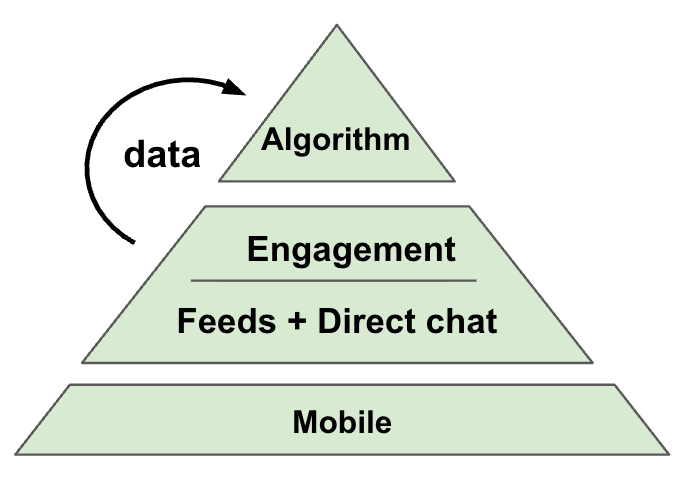

This was called the MDD (Mobile, Data, Direcruit) model. As we’ll see, these three building blocks working together to improve matching efficiency, reach a broader segment of the job market, and generate strong network effects.

From Search to Recommendation

As discussed earlier, traditional recruitment platforms suffer from low matching efficiency. Why? Because these platforms never truly leveraged internet technology to facilitate the matching process. Instead, they simply offered two long lists—one of job seekers, one of job postings—and left both sides to manually search through them.

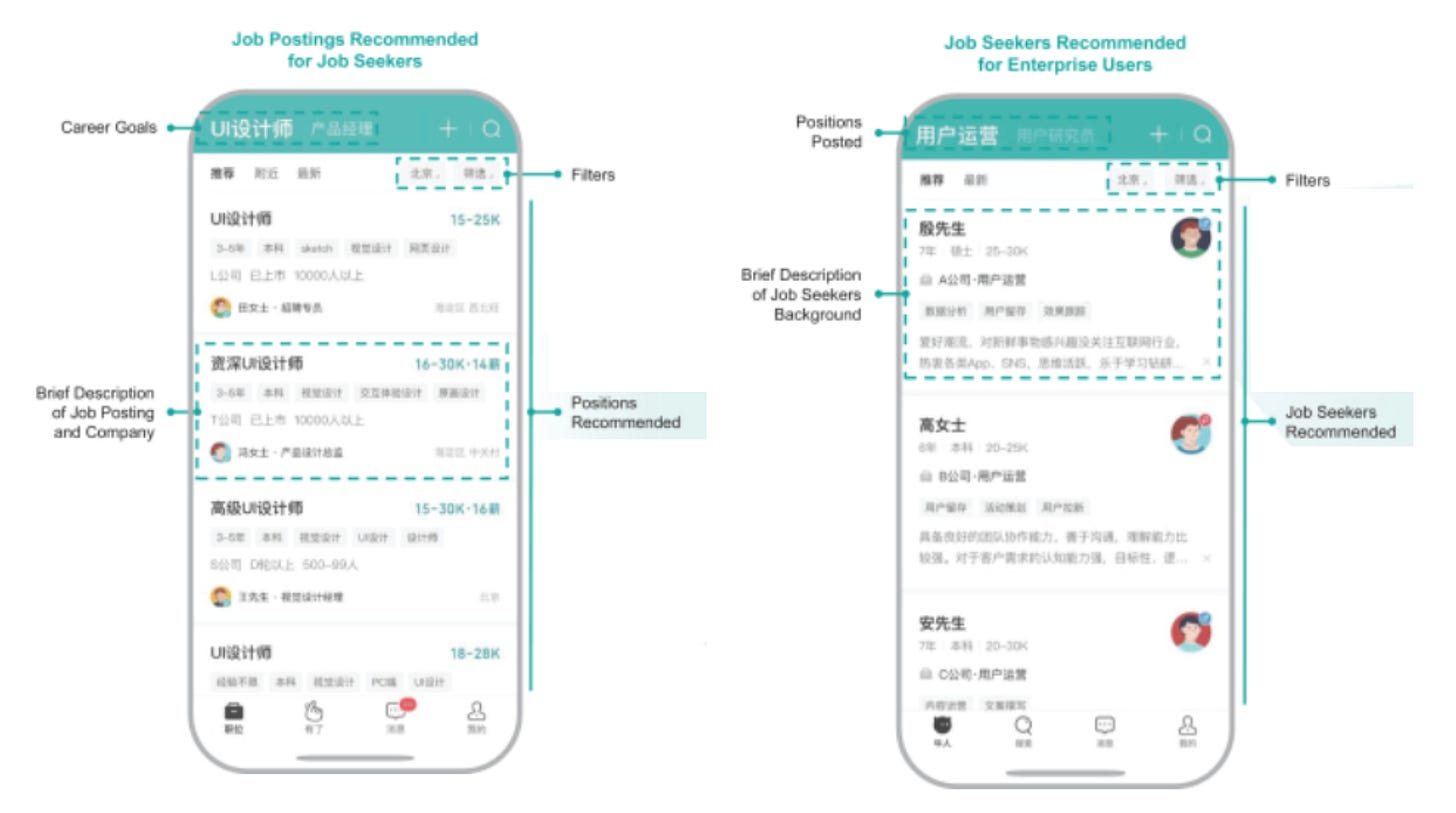

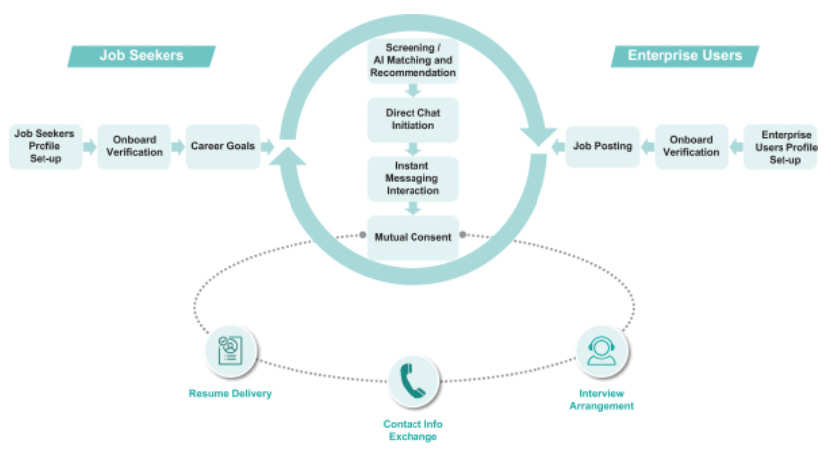

BZ addresses this issue through two-way recommendations. Whether you're a job seeker or a recruiter, the AI algorithm suggests higher-quality matches based on user profiles, resumes, and interaction history.

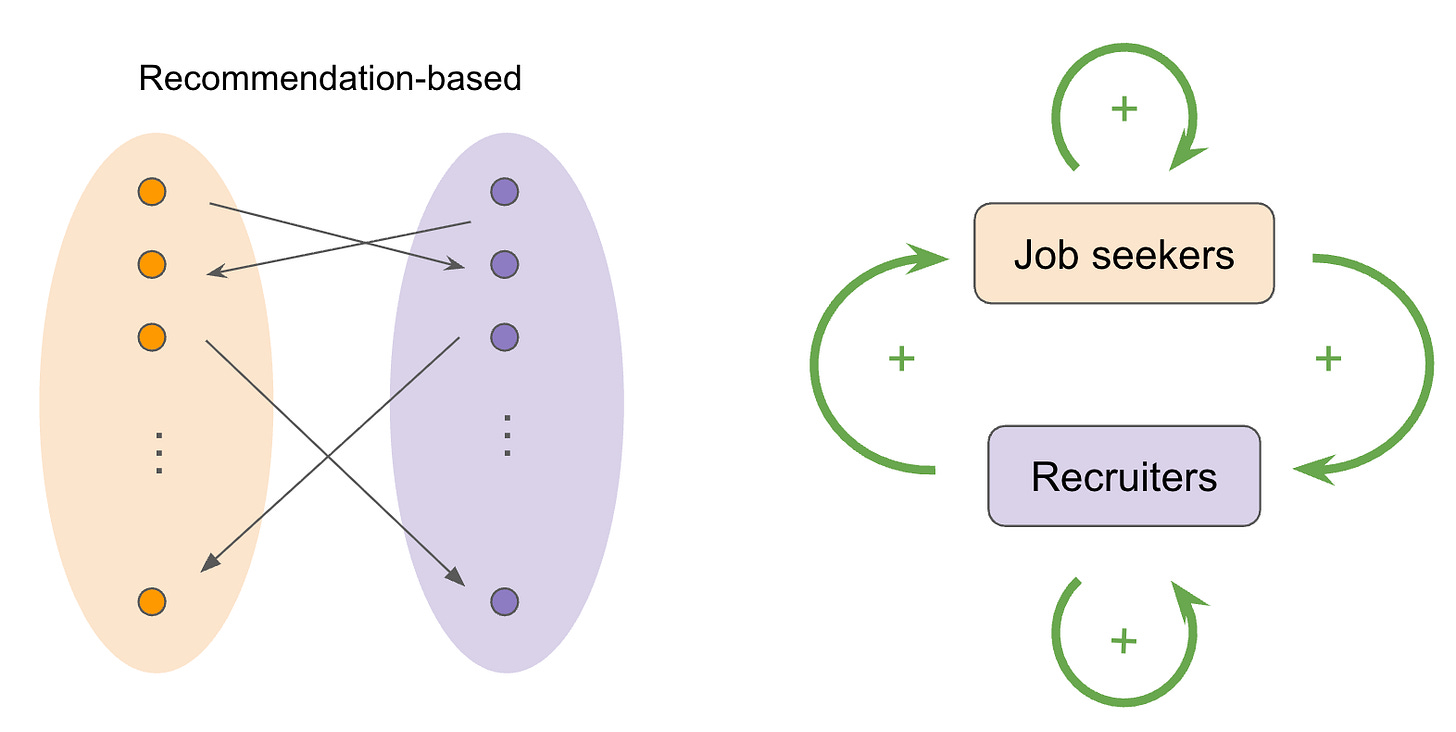

The recommendation-based approach creates a direct, two-way connection between employers and job seekers, giving long-tail users meaningful exposure. Furthermore, the ‘scrolling addiction’ improves engage and ultimate algorithm accuracy. Together, matching efficiency is significantly improved.

Recommendation also addresses the ambiguity often present in recruitment. Unlike shoppers who typically know what they want, many job seekers—especially early-career, aren’t sure which roles suit them best. In such cases, machine-assisted matching becomes especially valuable. This is also convenient for blue-collar workers — someone looking for a job at a bubble tea shop could just as easily work in a restaurant. These kinds of flexible, substitutable roles are far better served by recommendation than by manual search.

Replacing Resumes with Direct Chat

As for recruiters initiating direct conversations—this isn’t some groundbreaking innovation; it’s just how things work in real life. Liu Bei didn’t hire a headhunter to recruit Zhuge Liang... It’s been this way since ancient times.

— Peng Zhao

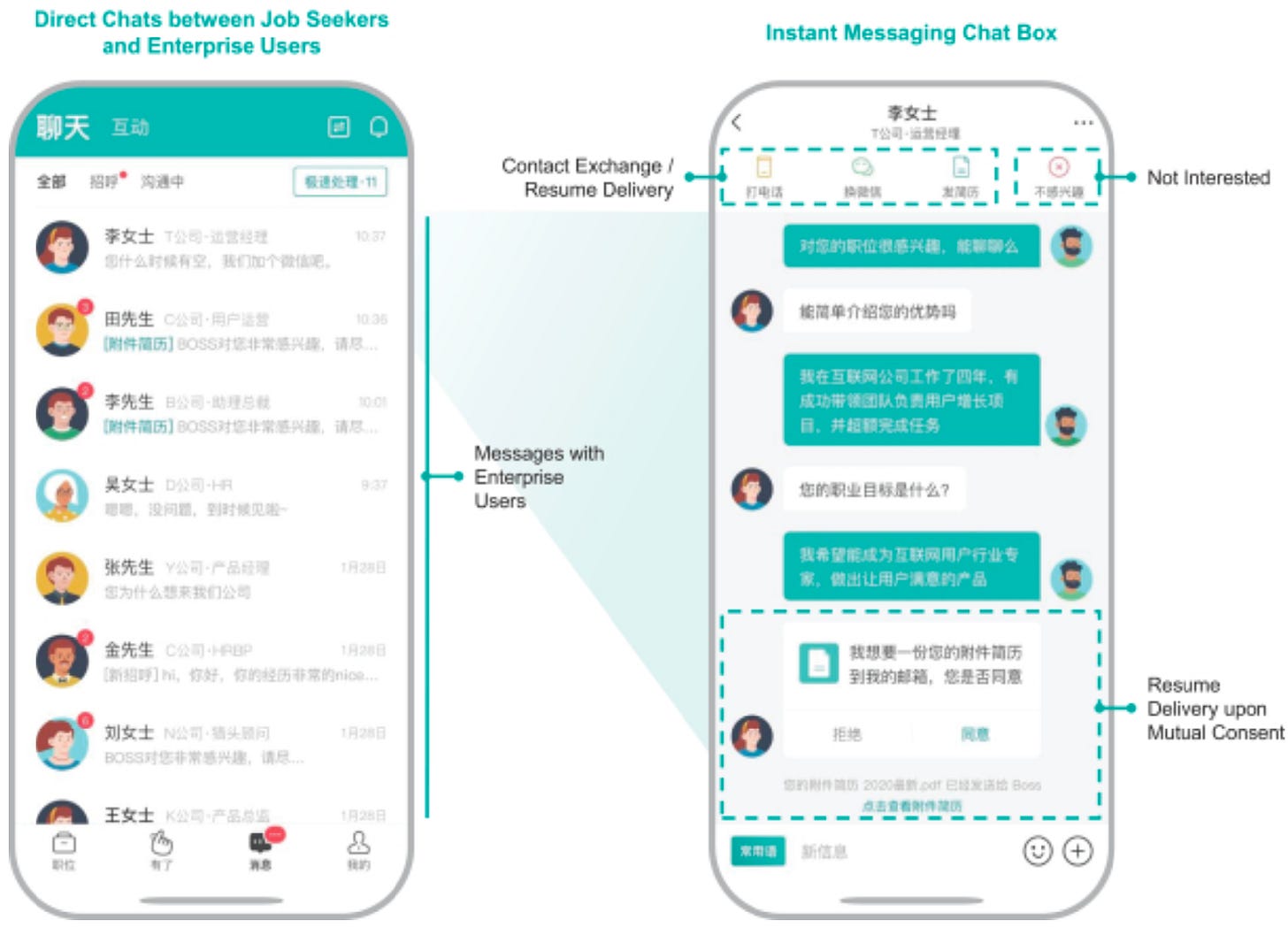

BZ also pioneered a direct chat model. Instead of starting with resume submissions, the first point of contact in online recruiting is replaced by instance messaging chat box, which can be initiated by either side. Once a conversation begins, both sides can choose to exchange WeChat, resumes, or other information with mutual consent.

Why was direct chat so quickly embraced by users? Here are three reasons:

It brings recruiting back to its natural form. Hiring, at its core, should begin with a simple introduction, and whether it progresses further should depend on mutual interest. Direct chat captures this dynamic far more authentically than traditional platforms.

Resume-based models inherently place job seekers in a subordinate position—essentially "begging" for a chance. This leads to a poor user experience: applicants send out resumes without knowing whether anyone even looked. On BZ, recruiters must respond and request access to a resume only with the candidate’s permission. Job seekers feel respected on BZ — what can be more attractive than that? This also aligns with China’s broader labor trends, where companies are now competing harder to attract talent.

As mentioned earlier, the resume-screening model is more suited to large enterprises with dedicated HR teams. Even for them, growing demands for innovation and flatter management have led to more direct hiring by line managers. Most importantly, by deprioritizing the role played by resumes, BZ is better positioned to serve China’s vast SME sector and the blue-collar workforce—groups often overlooked by traditional platforms.

Mobile native: product belong to the new era

As I mentioned earlier, BZ emerged alongside the rise of the mobile era. But what, to borrow Peng’s words, truly is a product belong to this new era? Is it just taking a website and turning it into an app? Definitely not. A closer look at BZ’s MDD model shows that every aspect of it is designed in full alignment with the mobile infrastructure.

At the heart of BZ’s model is its algorithm, which relies on large volumes of personalized data for training. That data is generated through recommendation feeds (swipe or click) and direct chat—interactions that are only possible on portable mobile devices. The PC environment simply couldn't support that level of engagement.

Strong network effect

Putting together what we have discussed so far, this is a snapshot of BZ’s consumer model:

As discussed earlier, several pain points severely limited the strength of network effects on the job board model. Therefore, we should expect BZ’s new model, which was designed specifically to address those pain points to enjoy much stronger and more scalable network effects.

Indeed, under the MDD model, not only the negative direct network effect is reduced, the size of network is also significantly expanded. Specifically,

By reaching both SMEs and blue-collar job seekers, BZ dramatically expands the number of network nodes. This is achieved directly due to the large number of SMEs and blue-collar workers, and indirectly due to the short life cycles of SMEs, as well as the high job-switching frequency of blue-collar workers.

Negative direct network effect due to competition was mitigated, as a result of BZ’s two-way recommendation engine. It increases visibility for long-tail users—those who would otherwise be buried in traditional search-based models—thus smooth out the severe imbalance in traffic distribution.

BZ’s reach into SMEs and blue-collar jobs introduces a new kind of positive direct network effects, thanks to the cross-industry liquidity. Unlike specialized verticals, blue-collar jobs and service roles are interchangeable. For instance, companies in AI compete for a small pool of Masters and PhDs. In contrast, a bubble tea shop doesn’t need to only consider someone who worked for bubble tea shop before, it can hire someone from a hot pot restaurant, convenience store, or even with little work experience. This drastically reduces same-side competition among employers. The same logic applies to blue-collar job seekers: they don’t need to restrict their search to one narrow category. This cross-industry flexibility reduces competition on both sides and effectively creates positive direct network effects, where more participants make the platform better for everyone without crowding each other out.

BZ’s Moat

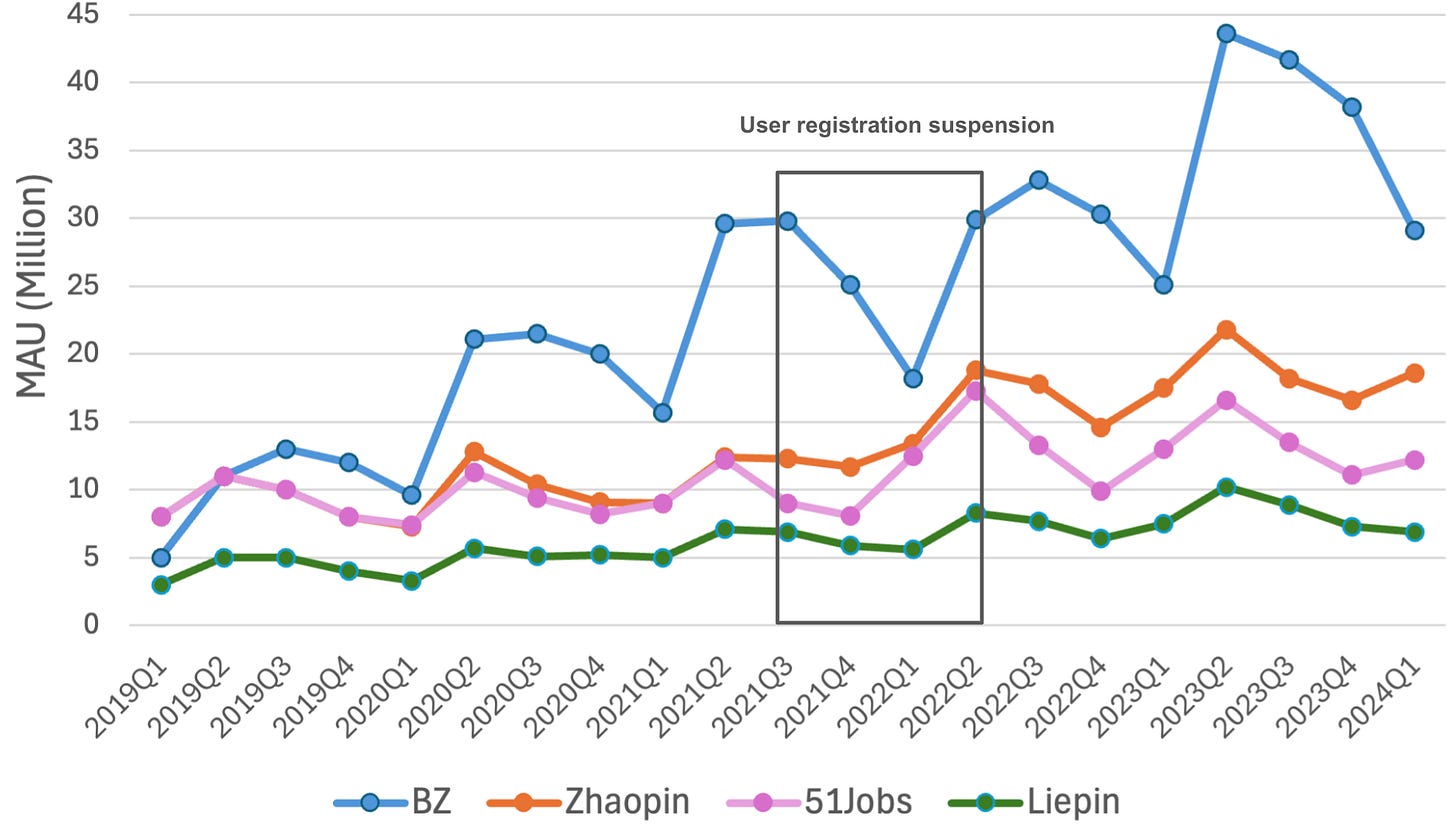

Evidences of moat

Readers familiar with my DiDi write-up know that I like to use ‘non-operational crises’ as a stress test for a company’s moat. Similarly to DiDi, BZ was hit with a year-long cybersecurity review, during which new user registration was suspended. Competitors attempted to seize the opportunity, ramping up marketing spend in an attempt to close the gap.

Result? BZ returns to high growth immediately after the ban lifted and the gap with its competitors is getting larger. According to the management, there were 50M failed user registration during the suspension!

Another evidence of BZ’s moat is the complaining about price from HRs. Based on my survey on social media and conversations with HRs, the common feedback is that BZ is getting more and more expensive. Since 2000, BZ has been steadily raising prices, and its annual package now ranges from ¥16,800 to ¥38,800.3 By comparison, Zhaopin and 51job charge only about one-third of that. Even Liepin, which focuses on mid-to-high-end recruitment, caps its most expensive package at just RMB 23,800 per year.

In other words, even with cheaper alternatives available, recruiters still stick with BZ. All they can do is to complain about it. Clearly there are something about BZ that are not replicable.

Why incumbents cannot replicate BZ's model

I tell my team: if your foot gets stepped on in a race, it means you’re not leading by enough — less than two strides. If you’re eight strides ahead, how could anyone step on your foot? They couldn’t even grab your clothes.

— Peng Zhao

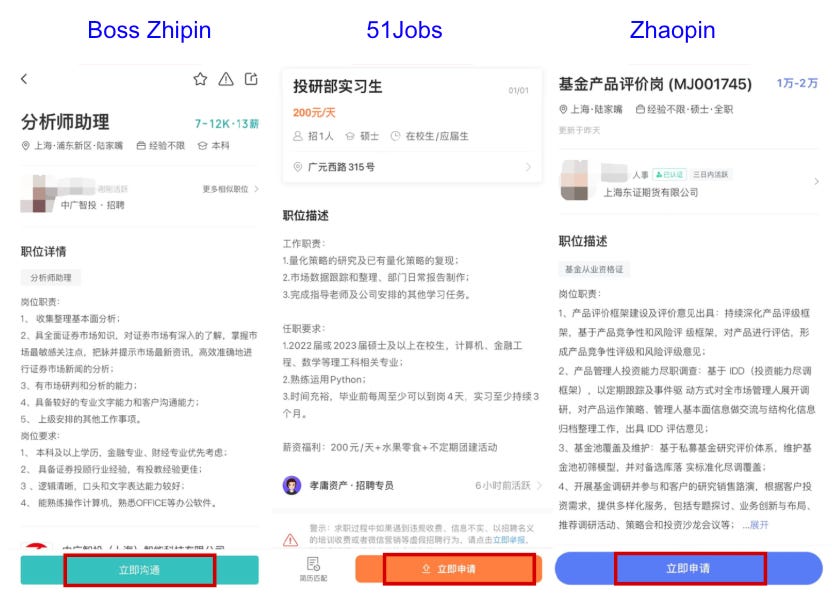

Astute readers might ask why 51Jobs and Zhaopin cannot copy the MDD model if everyone can find it in BZ’s prospectus. Well, to some degree, they did:

The UIs look almost exactly the same and each has a button where user can go into a messaging box. But if we look closerly, 51Jobs and Zhaopin failed miserably in their copying. For instance, on BZ, the button says ‘communicate now’ while in its competitors’ app its says ‘Apply now’. Even worse, if I click the apply button in 51Jobs, the first message is “Here is my CV” and my CV is sent automatically to the recruiter! For Zhaopin, things seem better — recruiter do ask persmission for your CV, but most of these are bot auto replies. Just look in Rednote and see how many HR complains that they didn’t even choose to initiate the conversation!

So you see the problem now. BZ’s competitors copied the shell and forgot about the soul. The existing MDD model, or whatever new policy or functionality BZ will launch in the future, is a result of BZ truly aims to improve user experience, to give applicants the respect they deserve, to facilitate matching.

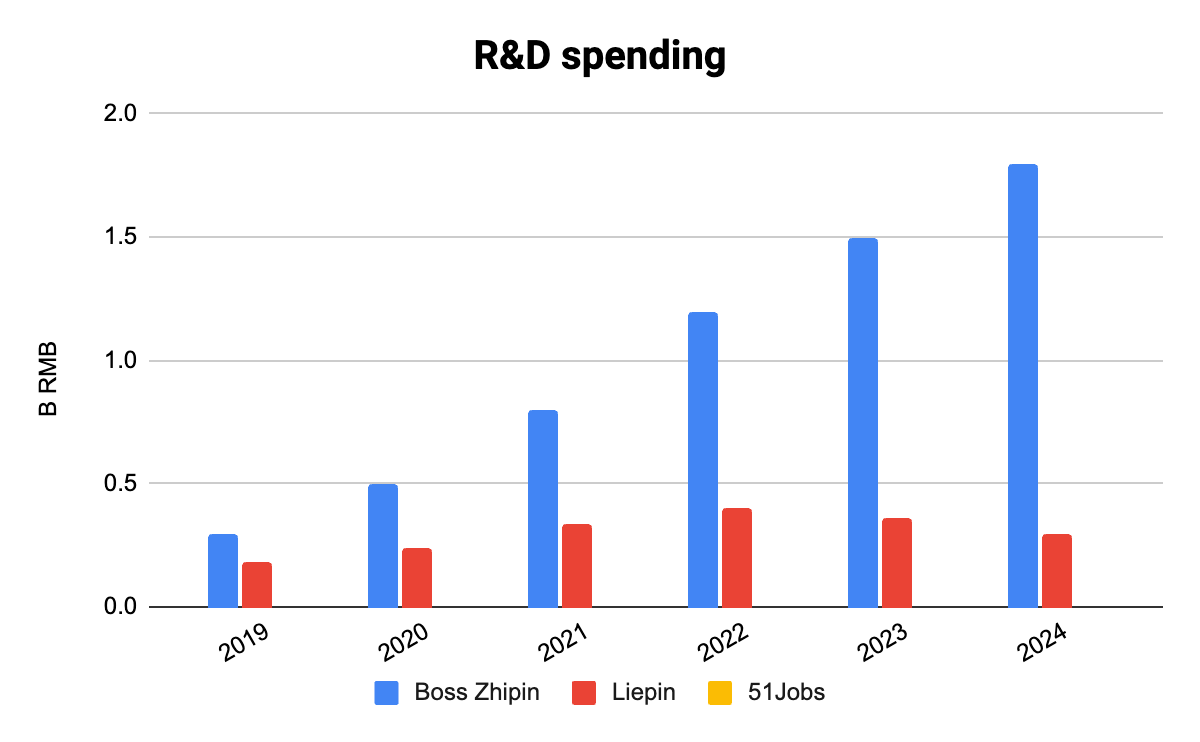

Let’s go deeper and ask why even today BZ’s competitors cannot offer true direct chat? Why they cannot strives for a better user experience? My answer is the culture difference. BZ’s mission is to better serve both enterprise and job seekers by leveraging technologies. Essentially it’s a research and R&D company. But its predecessors are sale company. Such difference cannot be more clear by look at their R&D spending:

Even worse, historically Zhaopin and 51Jobs primarily serve large enterprises—clients who are used to applicants begging to send in their resumes. Now imagine telling these core customers, the very foundation of their revenue, that from now on they’ll need to request permission to access resumes, and that job seekers will be placed in front of them instead. On top of that, management would need to slash the sales force and start paying top salaries to hire AI experts. The level of courage required to overturn such a deeply entrenched corporate culture and confront inevitable internal resistance is enormous. In reality, I’d say it’s almost impossible.

In summary, BZ’s model can be replicated in theory, but not in practice, by today’s major players. In that sense, BZ’s business is not a commodity. The difference in terms of user experience will only be enlarged as time goes by due to the compounding effect, and 51Jobs and Zhaopin are doomed to be eliminated eventually.

At the end of the day, our field just has to move more slowly. Because usage is infrequent, product managers and data engineers learn much more slowly, which in turn flattens the growth you can get out of each dollar invested. That’s why, slow is fast.

— Peng Zhao

Online recruiting is free from cut throat competition

Cut throat competition is a phenomenon cannot be ignored by investors investing in China. Specifically, it means burning billions in short terms to grab users from competitors by giving subsides, discounts and launching ad campaigns. If these tactics works for recruiting, maybe competitors can incentivize user to choose a slightly worse user experience. However, this turns to be not true for the following reasons:

Recruiting and job searching are fundamentally in-elastic demand. Unlike e-commerce or ride-hailing where subsides could encouraging more orders, more rides etc, this won’t work for recruiting. People looking for jobs when they need them, not because they’re offered a coupon; and employers hire when there’s a real vacancy. The same problem goes for ad campaigns, people won’t start looking for jobs because they see a big banner in the subway. That’s why these campaigns are only active in graduate seasons.

Recruiting and job searching are low-frequency behaviour, which also render short-term cash-burning campaign highly ineffective. Consumers might book rides or place orders multiple times per week, making it easy to influence their habit and mind share with short-term campaign. In contrast, the number of average work duration, even for 95 generation who are known for low loyalty, is 1.27 years. Paying people to sign up as job seeks can only lead to fake, inactive profiles or unqualified applicants.

Incentive of switching is low for enterprises. The cost of paying a platform is small comparing to the salaries they will pay or the loss it incur for not able to fill a needed role. Annual plan enough for several positions for recruiters on BZ costs from ¥10k to ¥30k, small company with few demand can choose to pay much less. The average annual salary in China is 100k. Therefore, recruiters cares more about whether there are enough job seekers using the platform than price.

In summary, several properties of the recruiting behaviour renders cut throat competition tactics ineffective, adding another layer of protection around BZ’s moat.

Growth drivers

BZ’s topline is fairly straightforward to analyze—it ultimately depends on how many enterprises are willing to pay and how much they pay. Breaking down the first factor, BZ’s enterprise growth is driven by three levers: penetration rate, paying ratio, and ARRPU.

While I only use enterprise-related metrics in my projection, this by no means diminishes the importance of KPIs on the job-seeker side. In fact, a large pool of active job seekers is the very reason enterprises remain engaged and continue paying. As we will see, the number of users on both sides of the platform is closely linked, a balance that BZ actively manages through deliberate modulation of supply and demand.

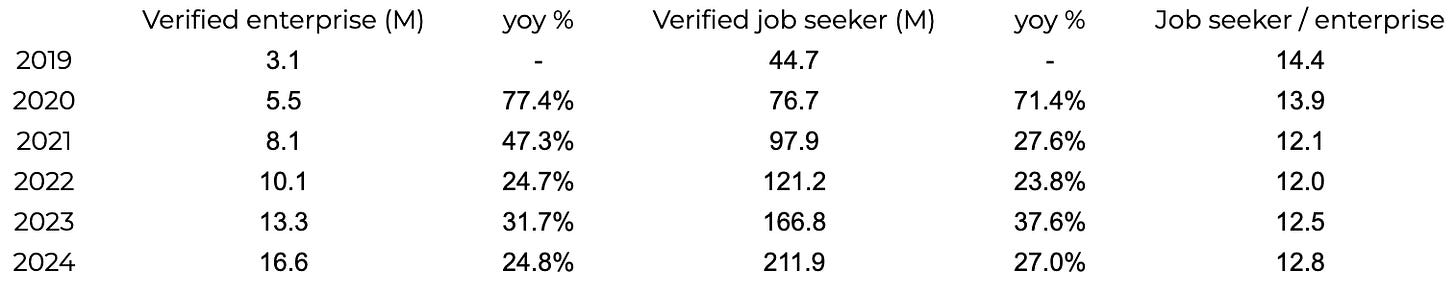

Verified User Growth

The number of registered enterprises (excluding self-employed) quadrupled from 13 million in 2012 to 51 million in 20224 , and reached about 61 million by the end of 2024.5 Over the past three years, despite a weak economy, the average annual growth rate has still been around 5%. Given the already high enterprise density compared with developed countries (36 enterprises per 1,000 people), I assume this pace continues to be conservative. This implies that by 2030, China will have roughly 80 million employer businesses.

BZ’s verified enterprise count has increased fivefold since 2019. The hypergrowth phase appears to have passed, with annual growth hovering at 20–30% over the past three years—with no new user registered for half year. I’m confident in the continued expansion of BZ’s user base for two reasons: (1) its business model is particularly well suited to SMEs and blue-collar hiring, supported by strong network effects; and (2) SMEs account for 98% of all enterprises, while blue-collar roles make up 70% of total non-farm employment.

To be conservative, and align with CEO’s expectation, I assume verified enterprises grow by 15% annually. Under this assumption, verified enterprises on BZ reaching around 33M in 2030 - this is just 42% of total employed companies in China.

We have several key structural growth drivers for our revenue, which is still unchanged. The first thing is the user growth. Even though of all these uncertainties, we expect that we can still have at least 15% of overall user growth.

— Peng Zhao, 2024Q2 Earning

Since the ratio between enterprises and job seekers has been relatively stable, due to active control of supply demand balance on the platform, growth on both sides are highly correlated. Therefore, under my assumption, total verified job seekers shall be around 426M or around 75% of non-farm employment in 20306.

Paying Ratio

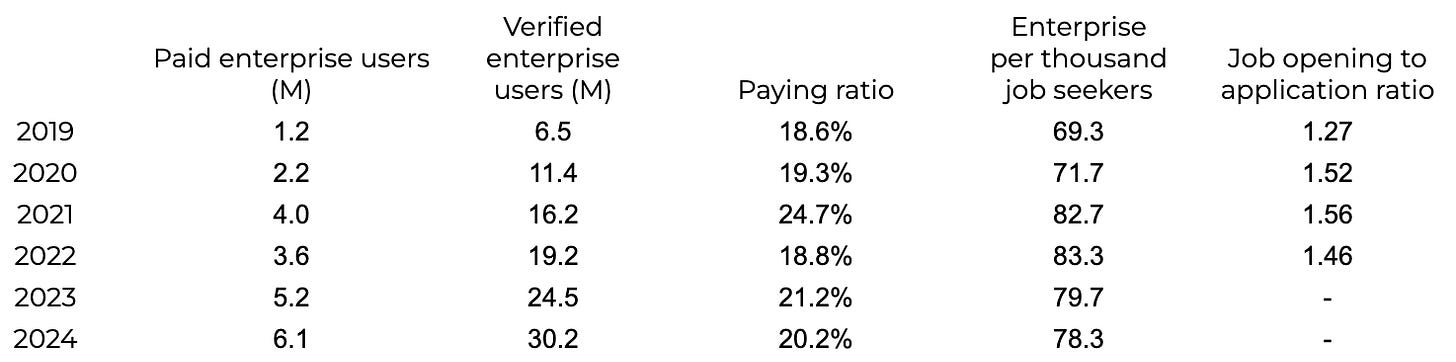

The upward trends of BZ’s paying ratio peaked in 2022 and has declined for two years:

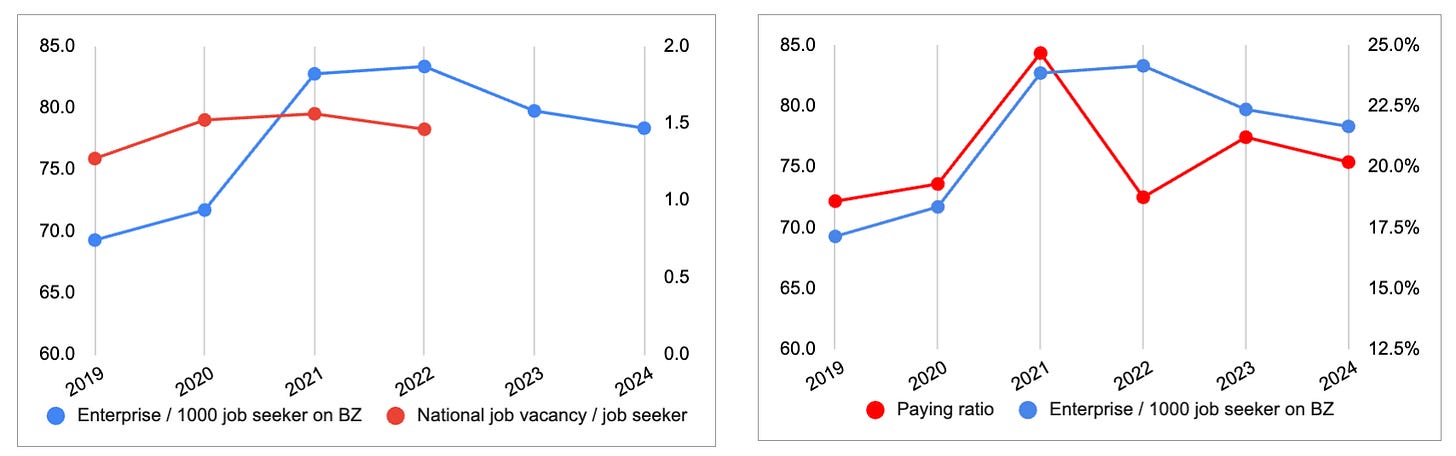

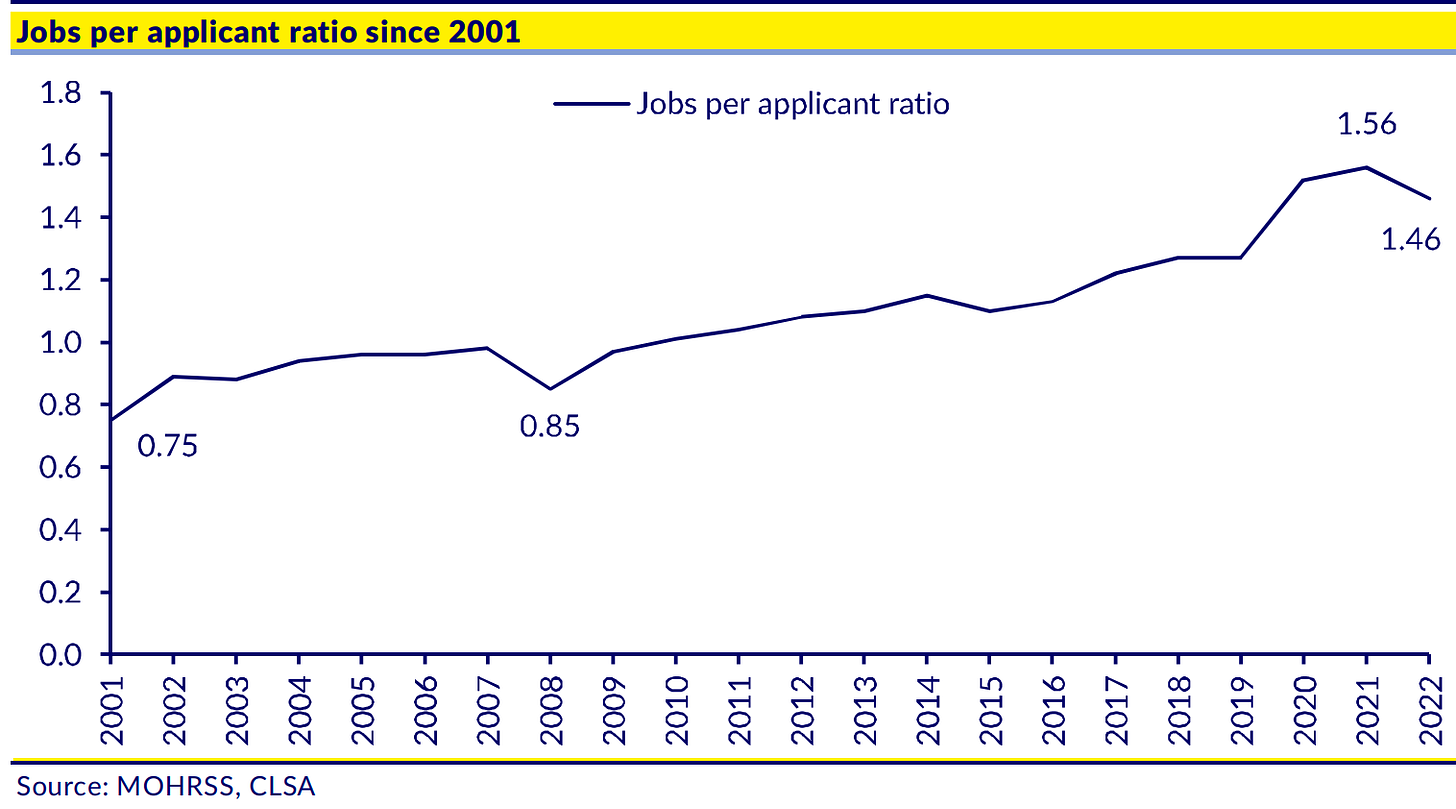

To understand this we need to understand that paying ratio is directly correlated with the supply demand in the job markets - often measured by the job opening-to-application ratio. When this ratio is high, many companies compete for one applicant. Not only BZ will charge a fee for posting ‘popular positions’, companies are also more willingly to pay, hence higher paying ratio. When the ratio is low, the opposite happens, companies grasp greater bargaining powers, leading to lower paying ratio.

To confirm this theory, we need to study the correlation between job-to-application ratio and paying ratio. However, Chinese government stopped publishing the job opening-to-application ratio after 2022. To get pass this barrier, I find that the ratio of verified enterprises to job seekers on BZ closely tracks the national benchmark (left figure), indicating that BZ’s platform is a representative sample of the broader job market. Therefore, we can use this proxy instead—and it indeed shows a strong correlation with BZ’s paying ratio. (right figure)

The decline in the job opening-to-application ratio—and consequently in the paying ratio—reflects the sluggish economy following the lockdowns. Therefore, in the short term, this driver will largely depend on the pace of China’s economic recovery. However, if we zoom out and look at the past decade, the longer-term trend points to a growing labor shortage:

I believe this shortage is likely to persist over the next decade. According to the 2024 China Statistical Yearbook, there were about 180M people aged 10–19 in 2023, compared with 247.5M people aged 40–59. This implies a net annual decline of roughly 6.7M in the working-age population over the coming ten years. The government is addressing this challenge through two main avenues: boosting birth rates and accelerating urban migration. The former includes policies such as the three-child initiative and a new nationwide childcare subsidy program, while the latter involves reforms to the hukou system. Both measures, however, will take time to show meaningful impact.

Back to my projection, to factor in the uncertainty of China’s economy recovery, I assume the paying ratio for BZ start to recover at 1% annually since 2025, 2026 and 2027 for my bull, base and bear case.

Average Revenue per Paying User

The ARPPU increased by around 36% over the past 5 years, slightly above government’s 5% GDP annual growth target. The number of small-size enterprise (contribute < 5000RMB) is more stable than that of key accounts and mid-size firms, reflecting BZ’s strong position in SME.

On one hand, ARPPU of 1000 RMB is quite low — around 2% of mid level annual salary of three tier cities. This leaves ample growth potential. On the other hand, CEO says clearly and multiple times that he will not consider aggressive increase this driver in the near team.

…our future growth strategy is that we will continue to attract more and more enterprises to pay for our service for their recruitment. That's my basic growth strategy. Based on this strategy of increasing dollar market share, especially our current market share is very low, so we are actually aiming at a company that has not paid for online recruitment at all. We should be very cautious in taking the payment strategy. In other words, I will not pursue the improvement of ARPU.

— Peng Zhao 2024Q1 earning call

And the third driver is our ARPUU. As far as we have got the first and second driver, which is enough, we are not in a hurry to aggressively increase our ARPUU. So it will keep at a stable and slightly improvement trend.

— Peng Zhao 2024Q4 earning call

I think there are two reasons why the management would not like to push hard on ARPUU:

Users are complaining. As mentioned before, many HRs are complaining about BZ getting more and more expensive. On one hand, this means BZ’s moat is strong; on the other hand, this put some pressures on management to increase price aggressively.

Peng believes in slow is fast. Chinese consumers’ willingness to pay for service needs to be cultivated over a long period. The top priority for now is to continue improving user experience.

Therefore, I assume BZ’s mixed ARRPU grow at long-term GDP growth rate of 2%. This is conservative considering China’s long term goal for the next 10 years is 5%.

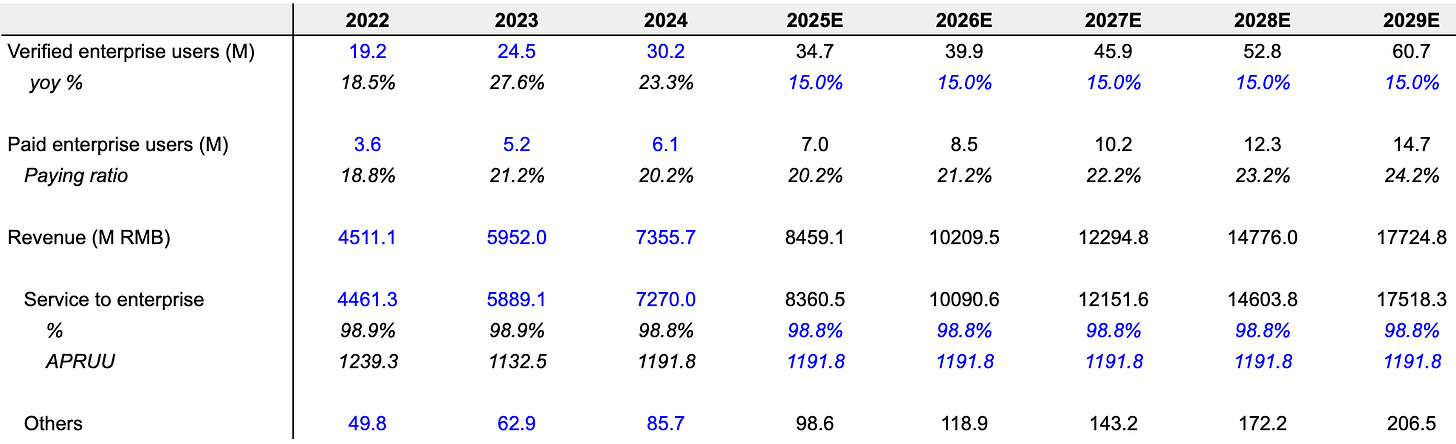

2025-2029 Revenue Bridge

Putting everything together, below is my base case revenue projection for next five years:

Specifically, I project BZ’s revenue in 2029 to reach ¥17B, ¥17.5B, and ¥18.2B under my bear, base, and bull case scenarios, respectively. CIC projects China’s online recruitment market at ¥220B in 2025. Even assuming no further market growth, BZ’s share would be only about 8% in 2029, indicating that my projections are far from aggressive.

Expense assumptions

Operating leverage

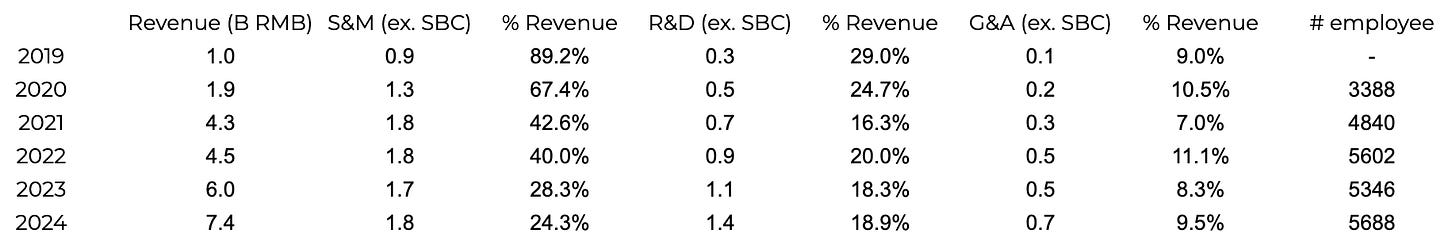

In terms of operating expenses, BZ allocates the majority of its revenue to sales and marketing, followed by R&D, with G&A being the smallest component. Since 2019, BZ’s revenue grown by 7x, while S&M only grow by 2x, R&D by 5x, and G&A by 7x. Stock-based compensation is not included here, but it will be factored into the valuation

The operating leverage is clearly demonstrated from the able above, and the CEO understand this perfectly.

We have very strong operating leverage, so as long as we can grow, most of revenue will turn into our profit. This is quite clear and simple.

— Peng Zhao 2024 Q2

What’s the source of operating leverage? Two things:

The nature of a tech-empowered asset-light platforms. Since 2020, BZ’s headcount has grown by only 68%. For example, the use of AI in security reviews has improved audit efficiency by 30%. This allows the company to handle the significantly higher workload from a rapidly expanding user base with only modest increases in staff. It’s remarkable that a workforce of just 5,000 people supports over 200 million users in the job market.

Economy of scale. Table below shows BZ and its competitors marketing expense and as percentage of their revenues:

Competitors spent a higher proportion of their revenues but only achieve half of BZ’s marketing expense. This effect will only be more evident as BZ grows further thanks to its strong network effect.

Below are my projection of each expense terms.

Sale & Marketing

I believe it’s unlikely that BZ will significantly increase its spending in the near term for two reasons. First, there is no real need—the company’s absolute spending is already more than double that of its competitors. Second, BZ has been carefully managing the supply–demand balance on its platform. Even if it could ramp up marketing and attract more job seekers than enterprises, the result would likely be a poorer user experience and reduced willingness to pay among employers. Therefore, I assume sales & marketing expenses will remain largely flat, rising only modestly from ¥1.8B in 2024 to about ¥2B in 2029

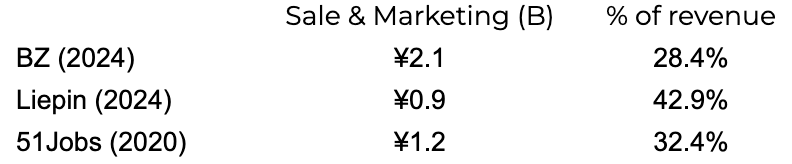

R&D and Capex

My projection for R&D spending rests on two key points:

First, while BZ’s R&D expenses will continue to grow over the long term, they will not outpace revenue growth, thereby preserving operating leverage. BZ is fundamentally a tech company, so that investment in R&D will continue. But R&D is a long-term effort. There is no point aggressively ramping up short-term spending which would only hurt profitability.

Second, I expect R&D expenses and capex to decline in the near term as a correction to the AI-hype-driven overspending of the past two years. I am very satisfying with management’s approach to generative AI. Rather than chasing hype, they have taken a measured, disciplined stance. This is best explained by CEO himself:

Regarding the generative AI, … there are two points. First, in a scientific perspective, we are executing a taillight project, which is for our research guys, our tech guys to understand, to know what the most developed technology in this area is and what they are doing. But we are not planning to invest more resources. Actually, we're not affordable to do that, to actually do that. We just know what they are doing and kept up with the most advanced technology.

— Peng Zhao, 2024Q3 earning call

And what has BZ learnt after this short-term investment about AI?

I still think that the entire industry, not just our industry, but all industries in AI, In terms of AI application, the reality is the high prospect of the technology cannot correlate with the real actually application scenario. So there's a very loud lightning, but very small rain. So that's an industry fact.

— Peng Zhao, 2024Q4 earning call

A few words on my thinking about AI. LLMs are, and will increasingly become, a commodity. Smaller but equally powerful models will soon be widely accessible. Ultimately, even if AI applications gain widespread adoption, the real winners will be the companies that possess critical industry knowledge and proprietary data.

Back to projection. As BZ already catch on up generative AI, BZ will cutback on its investment on this front. This already shown in capex down by 10% yoy in 2024, and the R&D expense in 2025Q1 down by 9.4%. Combining my two thesis points, I project BZ’s R&D spending decreased by 10% in 2025 and 2026, and grow again at 10% starting from 2027.

Other assumptions

G&A expense has been quite consistently stay at around 9.2% of the tot revenue. Other than this, I don’t have any extra insight, so I assume it says at such level in the future.

Gross margin dropped 87% to as low as 83% in 2022 and 2023. This is due to the slow revenue growth (5%) in 2022, increasing security measures and heavy investment in AI. As the growth came back and BZ dial down its investment in generative AI. Gross margin has been recovering in 2024. I assume this to continue and stabilize at 85% to be conservative.

Tax expense. PRC enterprises in general are subject to a 25% income tax. However, BZ’s effect tax rate has been below 15%, due to both a preferential tax rate of 15% for qualified High and New Technology Enterprise (HNTE) and tax reduction from certain quality R&D expense. I expect the HNTE status maintained in the foreseeable future as BZ will continue invests heavily in R&D. So I assume tax rate of 15% in my projections.

Share-based compensation. SBC spiked to more than 15% of revenue over the past few years, due to IPO in 2020 and the dual listing in HK in 2022. As management mentioned, SBC will go down in the future. Most of such one-time SBC will be taken into account as dilution when I calculate value per share later. However, BZ will continue issue new SBC to attract talents in the future. I assume a long-term level of 2% of revenue for that — a reasonable amount for matured tech company.

2025 — 2029 FCF Bridge

Since my I have considered the impact of the capex in my expense assumptions, I use NOPAT to approximate FCF assuming D&A is roughly equal to maintain capex. Combining my revenue projection from last section, below is my base case 2025 -2029 FCF projection:

Under my projection, EBIT margin achieves 56% due to operating leverage. Around 46% of revenue goes to owner’s earning.

Valuation

Share-based compensation

I have not consider the impact of SBC so far, as they are non-cash. However, they are dilutive thus real costs to shareholders. At the end of 2024, there are 31.5M RSUs outstanding, and 44.7M share of exercisable options with a weighted average exercise price $3.11 ($6.22 for each ADS). Since today BZ is trading far above that, I count all of them ITM in my calculation of value per share.

Since I’m using 2025Q2 number for cash and shares outstanding etc, I need to estimate the latest outstanding SBC to be consistency. Very crudely, I assume the outstanding options and RSU continue decline at previous years’ rate and linear over quarters:

There are 883M ordinary shares outstanding at the end of 2025Q1, so the total dilution (excluding cash received from option exercise) is around 7.7%.

Exit multiple

The multiple the market assigns to BZ in 2029 will largely depend on its growth prospects at that time. If growth potential appears limited, a low multiple—say around 15x EV/EBIT—would be justified. However, this seems unlikely given 1) my projection of 25% profit growth in 2029, and 2) my five-year forecast assumes only a continuation of management’s current strategy.

At present, BZ focuses on expanding its user base while being conservative on monetization. Once user growth begins to plateau and stickiness strengthens further, management will almost certainly shift emphasis toward raising the paying ratio and ARPPU. With a potential 20–30% paying ratio and ¥1,000 ARPPU, the monetization runway beyond 2029 remains substantial. That will be the growth story beyond 2029.

Let’s look at comps. There are four public companies with online recruiting businesses that I’m aware of: Recruit Holdings, SEEK, Liepin, and ZipRecruiter. The last two are not doing well, with revenue declining over the past three years. Liepin, which focuses on gold-collar positions, may not be a fair comparison to BZ anyway.

Recruit and SEEK has established international footprints via acquisition. Recruit is more diversified, operating not only in recruiting but also in staffing and matching platforms across travel, food, and other verticals. SEEK may be the closest comparable, as it is entirely focused on online recruiting platforms and has a strong presence in Asia, including Hong Kong, along with a stake in Zhaopin. Both Recruit and SEEK have historically traded in the 20x–30x EV/EBIT range.

Therefore, I consider EV/2029 EBIT of 15x, 20x, 25x for my bear, base and bull case scenarios.

How about new business opportunities? Broadly, there are two paths. One is to penetrate deeper into the HR industry, which is roughly four times the size of the recruitment services market. The other is to replicate BZ’s model in other countries. Based on my understanding of Peng—who is cautious about entering unfamiliar markets and reluctant to compete on others’ turf—option one seems unlikely in the near term. In fact, BZ has already begun experimenting with overseas expansion, though little detail has been disclosed so far.

…we believe a business and revenue model that has proved in China, we hope we can deploy it in other countries/regions. And hopefully in the next 3-5 years that will be our new growth driver.

Peng Zhao, 2023Q2 earning call

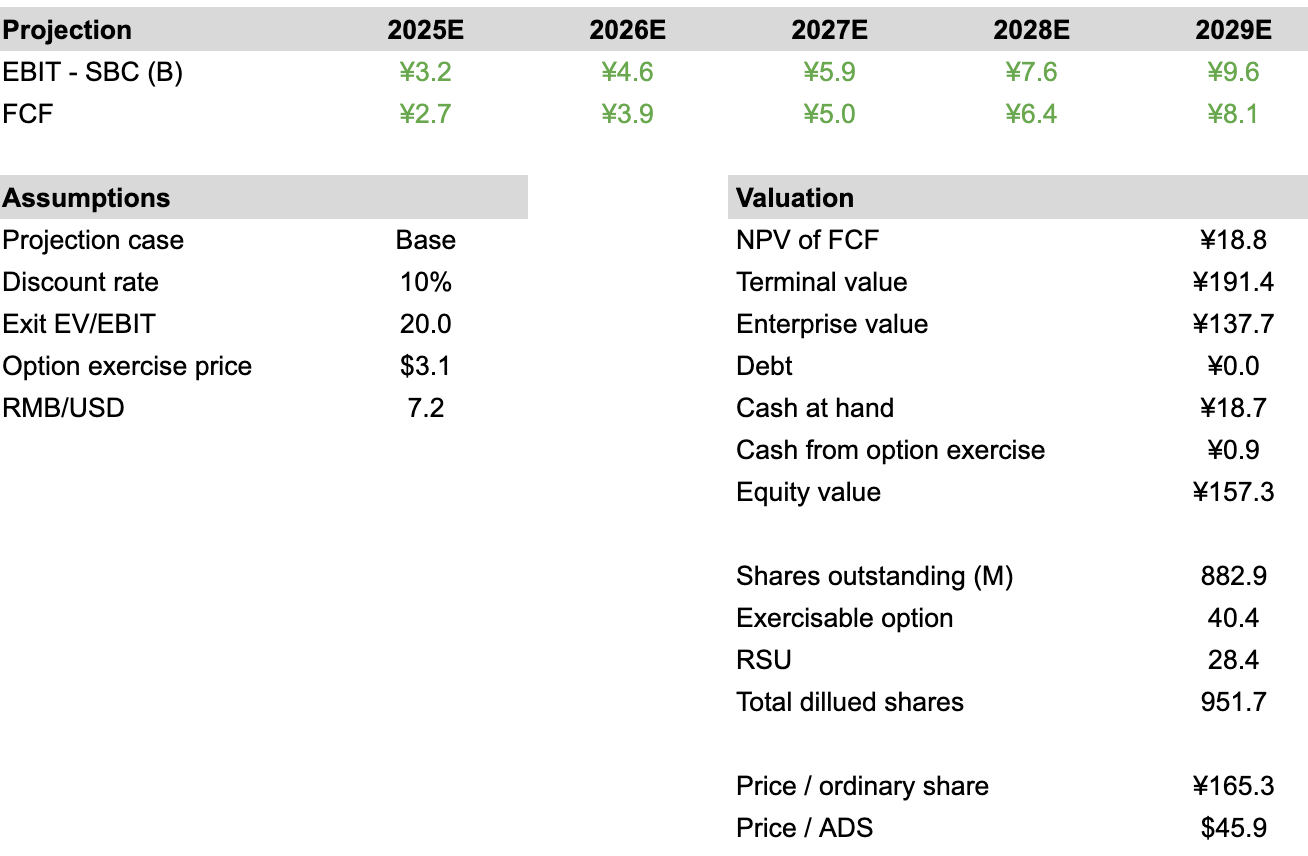

DCF

Putting everything together, I calculate BZ’s intrinsic value to be $35 — $57/ADS. Below is the DCF model for the base case:

Note that I assume all cash remains in the bank, which is too conservative. From 2020 to 2024, BZ spent ¥2.67B on share buybacks, and management has just announced a new $200M buyback plan. If they continue allocating around 30% of operating cash to repurchases in the coming years, it could be highly accretive to BZ’s intrinsic value.

CEO and founder

If you’ve read this far, you already have some sense of BZ’s founder and CEO, Peng Zhao. Except for the quotes from earnings calls, the ones I shared come from a book based on an extensive interview with him:

I highly recommend this book and have read it at least twice. Each time, I ask myself how someone like him can remain largely unknown to value investors focused on China.

Peng’s background

In fact, much of his character can already be glimpsed from his usual background:

1994 – Graduated from Peking University Law School.

Same year entered government work; served as Project Development Director at the China Youth Volunteers Association.

Helped organize the pioneering “College Students Volunteering in Western China” program.

By July 2020, program sent nearly 300,000 graduates to 22 provinces, with 20,000+ volunteers active annually.

2005 – Left government as a division director after 11 years at the Communist Youth League.

2005 – Joined Zhaopin as PR manager.

2010 – Promoted to CEO of Zhaopin.

2013 – Founded Boss Zhipin

What can we tell from this mini-resume?

He is a seasoned leader, with extensive management experience both in government and at Zhaopin.

He has a deep understanding of the industry and business in general. He learn old model’s pain points with first hand experience in Zhaopin.

Without these two points, it’s impossible for him to build a successful tech company with zero tech background.He has strong integrity. The volunteer program he started is still active and making a real impact today. In earnings calls, he often emphasizes how BZ strives to help young graduates find jobs they truly enjoy.

Finally, it’s worth noting that Peng’s government experience gives BZ an edge in navigating China’s complex policy landscape—an advantage most other tech companies simply don’t have.

The author of this write-up owns shares in the companies mentioned and may purchase or sell shares without notice. This write-up represents only the author’s personal opinions and is not a recommendation to buy or sell a security. No information presented in the write-up is designed to be timely and accurate and should be used only for informational purposes. Readers of the write-up should perform their own due diligence before making investment decisions.

China’s retail gross volume is¥50T in 2024, GMV of top 5 e-commerce players is already at¥25T. https://www.gov.cn/zhengce/202507/content_7032736.htm

Don’t mistakenly think this means BZ has little room to raise price. As we will see later, the ARPPU is just around ¥1000!

https://www.gov.cn/xinwen/2022-10/11/content_5717139.htm

https://www.gov.cn/lianbo/bumen/202502/content_7002934.htm

I estimate the non-farm employment to be around 570M in 2030, factoring into the decline of total population and continuing urbanization.