DiDi Update #1

H1 2025 sees 116% EBITA growth, loyalty program upgrade, battle with Meituan in Brazil

A lot seems to have happened since my last post on DiDi. In July, Goldman Sachs initiated coverage on DiDi with a buy rating, after which the stock has been volatile. Last week, DiDi disclosed in their Q2 release that it had settled a shareholder class-action lawsuit for $740M.

These developments make may investors believe that a DiDi relisting is becoming increasingly likely. While I also think a relisting is plausible, it’s important to remember that this is just speculation. Ultimately, the success of this idea depends on whether DiDi can execute well and whether it is undervalued—not on where it is listed, or even if it is listed at all.

For the first half of 2025, DiDi reported ¥4.9B in adjusted EBITA (ex-SBC), up 116% yoy. Even assuming a flat second half, and with ¥62.6B in cash & equivalents, the stock is trading at 15.6x EV/2025E EBITA—this is after a 30% appreciation since my initial write-up. This outcome is the result of strong performance in China and contained losses in international operations and other initiatives. Let’s break it down.

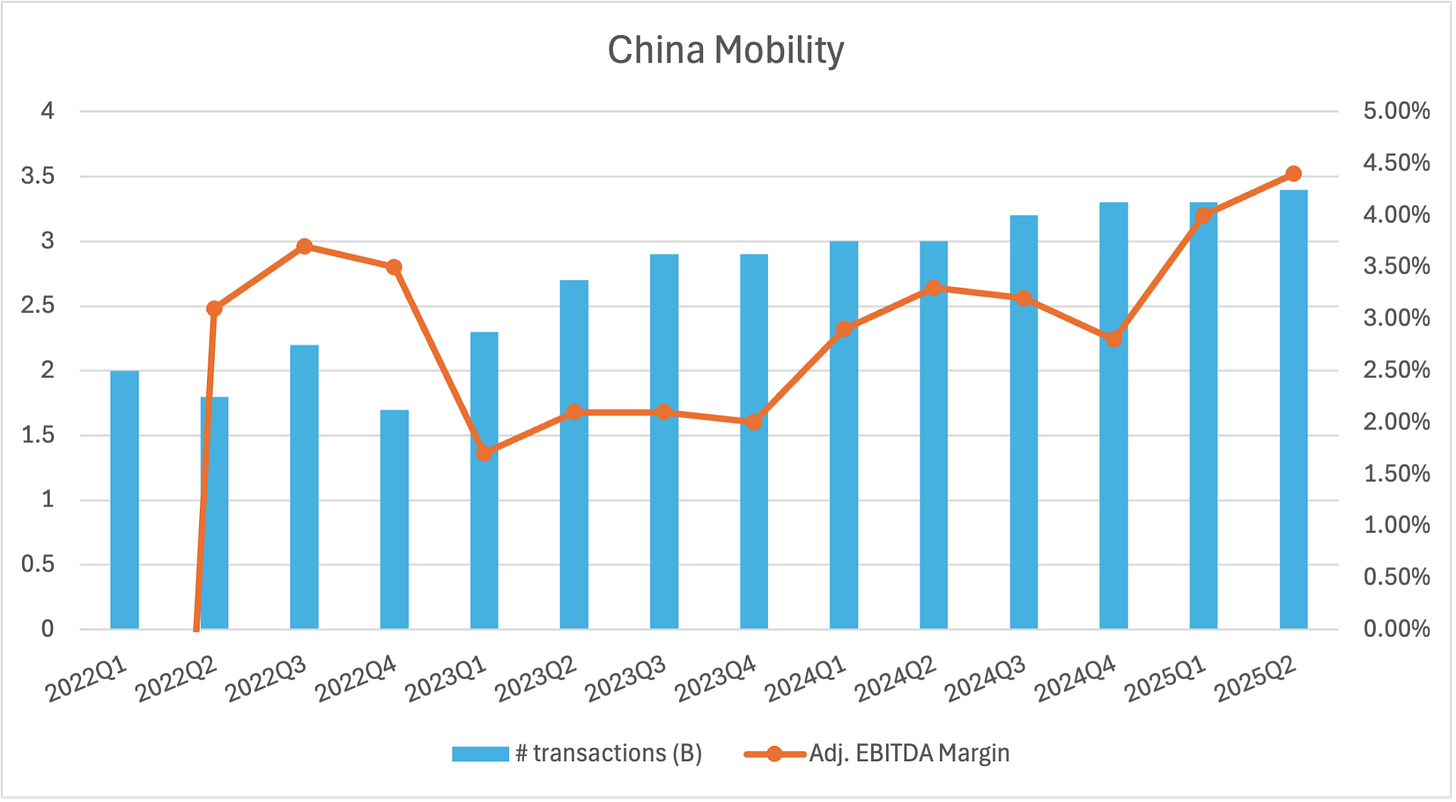

China Mobility: Continued strong performance

For H1 2025, total transactions rose 15.2% YoY, while GTV increased 13.7% YoY, hitting the upper end of my topline growth assumption range of 3%–13%. Adjusted EBITDA margin reached a new high of 4.5% in Q2, putting it on track toward my 6% target. Overall, I think DiDi’s China segment has executed exceptionally well so far in 2025. In fact, DiDi has consistently performed well since 2023 as shown below.

It’s worth taking a quick look at what has happened since 2022. Order numbers were flat that year due to both the suspension of new user registrations and Covid lockdowns. Despite this, the margin in 2022 was relatively high at 3.5%, although it was masked by the 8 billion RMB fine paid (notably, DiDi chose not to exclude this from adjusted EBITDA).

As I discussed in my deep dive, the company’s immediate return to growth highlights its moat. Order numbers went on a streak of 10 consecutive quarters of growth. The margin decline in 2023 suggests that more subsidies were deployed to reclaim market share from competitors. By 2025, the margin of 3.5% achieved in 2022 was finally surpassed.

Speaking of margin, on August 22nd, multiple ride-sharing platforms were widely reported to have announced reductions in take rates, causing DiDi’s stock to drop 6% that day. A closer look, however, shows that the announcement was about reducing the maximum take rate to 27%. I’m not worried about this for several reasons. 1) it appears to be largely a gesture to the government. 2) recall that my calculations suggest DiDi’s average take rate is only 24%, so the reduction doesn’t have any material impact. 3) as I noted in my writeup, I expect a large portion of margin expansion driven by lower consumer subsidies and operating leverage.

Loyalty Program Upgrade

Before moving on to DiDi’s international operations, I want to highlight its recent loyalty program upgrade. Recall the key drivers of DiDi’s growth are MAU and trip frequency. In other words, DiDi needs to strengthen user stickiness and boost user engagement, and the loyalty program is a good example of how the company is doing so.

Following the upgrade, the program now features eight membership tiers. Each tier is earned by reaching a certain mileage threshold over the past three months and comes with progressively better perks. Below is an example of perks enjoyed by a v7 member (translation is mine):

A user can unlock Level 7 perks by accumulating 1,100 mileage points over the past three months. Different service has different multipliers. For instance Level 7 needs 1,100 miles from DiDi Express or 370 miles from Chauffeur. In addition to several ride-hailing–related perks, the more interesting feature lies in the Partner Perks (highlighted in the red box). Let’s go through each of them and, more importantly, assess their value:

H World Platinum Membership – Obtained by upgrading from Gold membership (¥219) with 40 room nights. Using ¥300 per night (H World’s Q2 ADR was ¥296), this perk is worth ¥12k.

Hilton Gold Membership – Requires 40 room nights. At an estimated RMB 600 per night, this perk is worth about ¥24k.

Atour Platinum Membership – Requires 24 room nights. With an ADR of ¥440 according to Q2 2025 report, this perk is worth roughly ¥10.6k.

Haidilao Golden Sea Membership – Requires ¥6k in spending to unlock.

Putting everything together, DiDi’s Level 7 membership is worth at least ¥42k—you just need to keep riding with DiDi to get it. What a very clever way to boost customer engagement and loyalty. I’ll wrap up this section with two questions for you to chew on:

Would these partner brands want to form similar partnerships with DiDi’s low-price competitors on Amap? Are customers chasing a ¥1–2 discount really their target audience?

Would it be difficult for DiDi to charge, say, ¥50 for a membership worth >¥10k? With 10 million paying users (vs. current MAU of over 100 million), that would add ¥500 million directly to the bottom line.

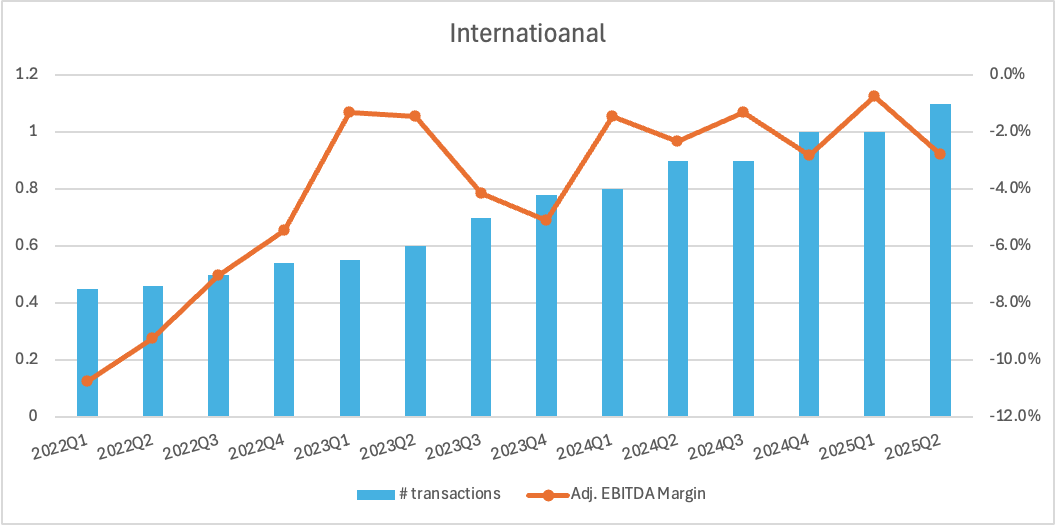

International Business: High growth, early days for profits

For the first six months of 2025, the number of transactions reached 6.6B, up 25% yoy (a better metric to study trends, as GTV was affected by forex fluctuations). Adj. EBITDA during this period enlarged by 9.4% to ¥-0.9B. As shown below, the EBITDA margin has been shrinking toward break-even but has plateaued since 2023.

In my deep dive, I highlighted that the biggest uncertainty for DiDi’s international business is when it can achieve profitability. Indeed, it is still early to discuss profits—especially considering DiDi has just announced the relaunch of its food delivery service in Brazil and the chaos brought by Meituan.

In April, 99Food announced its return to Brazil, outlining an expansion plan with R$1 billion in investments to reach 100 cities by mid-2026.1 s this a wise move, given that iFood already holds a 80% market share in the country? It will certainly be a challenging task, but it makes sense to me for two reasons:

Brazil is the largest market in Latin America, with the highest population and GDP. Today, the food delivery sector completes only 0.02 orders per person, indicating significant growth potential. As 99’s managing director in Brazil noted, “Growing fivefold in the next 3–5 years is possible.” I’d add that during this 5× growth, the competitive landscape could change dramatically—and no one should underestimate the capabilities of a Chinese team.

DiDi (99Taxi) already holds a 30%–40% market share in Brazil, with 700,000 registered motorbike couriers across more than 3,300 cities. It would be a missed opportunity not to leverage this network to expand into the food delivery business. The potential synergy is highly compelling.

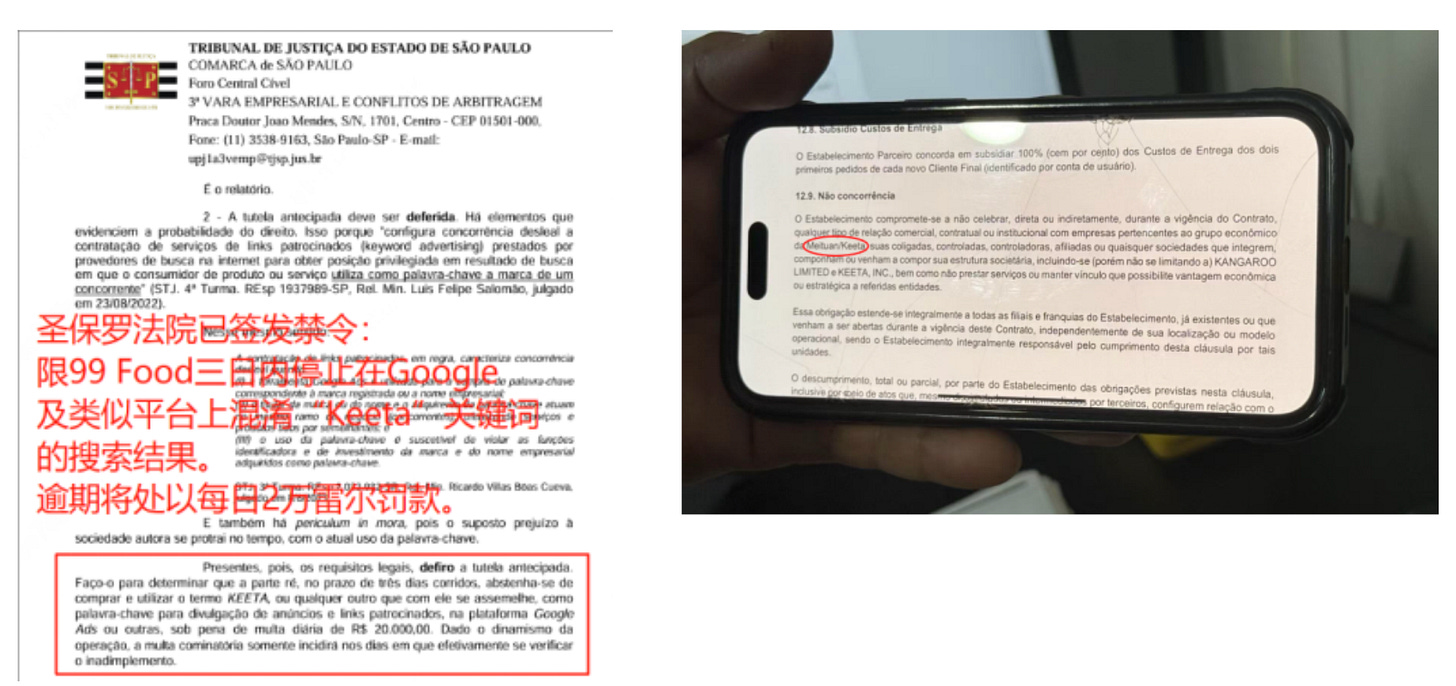

However, things got messy when Meituan decided to enter Brazil immediately following DiDi’s announcement. The two have been battling in the Central Court of São Paulo recently .

The dispute began with Keeta (Meituan) suing 99Food for 1) bidding aggressively on the keyword ‘Keeta’ on Google to confuse its search results and 2) preventing some of its partner restaurants from signing contracts with more than two delivery platforms (similar to what iFood did to DiDi back in 2021).2

Meituan counter attacked by filing lawsuit accused Keeta of using colors, graphics and font similar to 99's platform to "catapult its commercial operations" in the Brazilian market.3 I have to say, the following pictures gave me a good laugh 🙂

Honestly, Meituan’s move puzzles me, as they have no prior presence in Brazil like DiDi. During the ongoing food delivery war in China, Meituan seemed like the victim of JD. Perhaps it’s time to echo what Confucius said 2,500 years ago:

Do not do unto others what you would not have them do unto you

己所不欲勿施于人

In summary, with the new investment in Brazil and the intrusion of Meituan, I wouldn’t be surprised to see DiDi’s international segment losses edge higher in the remainder of 2025.

Wrap up

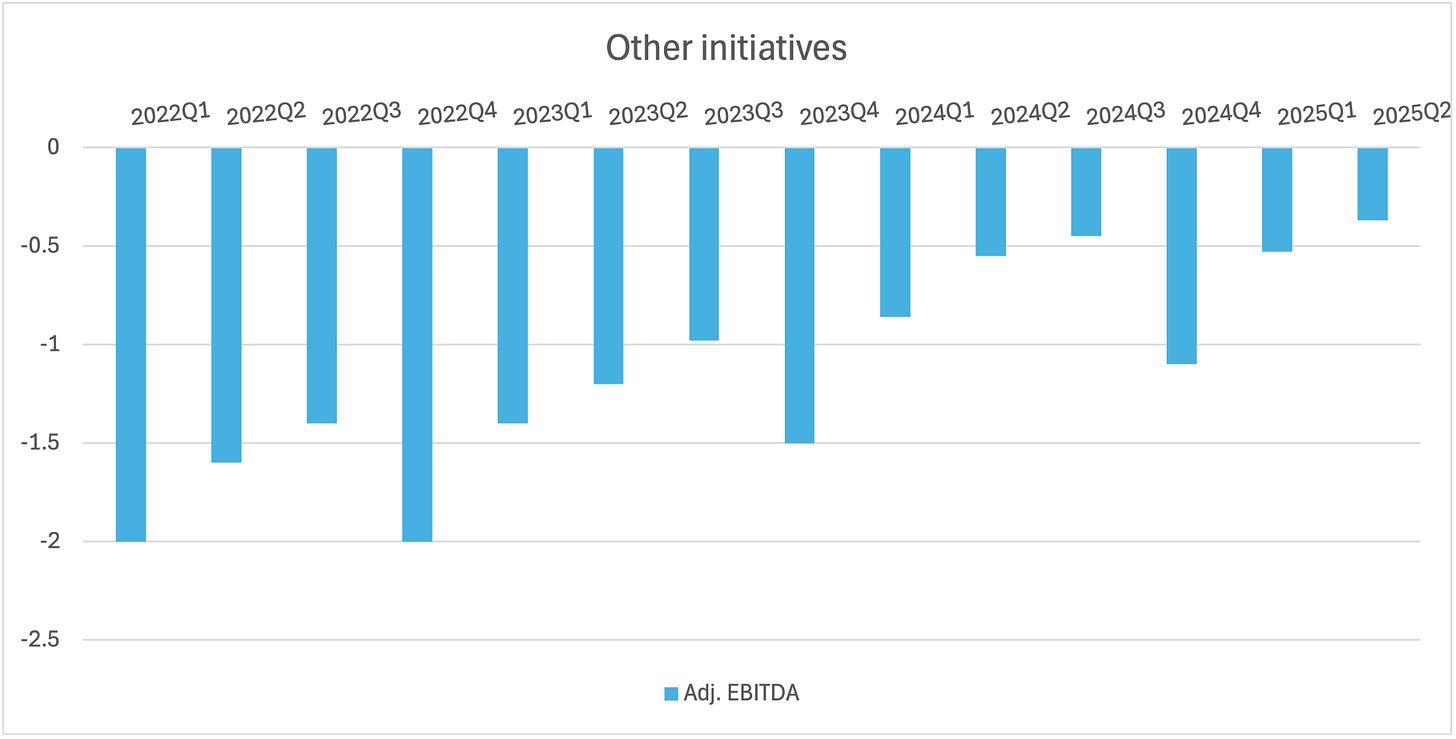

Finally, let me point out that we saw a record-low loss for Other Initiatives in 2025Q2—let’s hope this trend is sustainable.

Together, this results in ¥4.9B in Adj. EBITA for the first six months of 2025. Share-based compensation has been trending down over the past three years, which should help close the EBITA–earning gap.

Another welcome update is that, under the new share repurchase program commenced in March, DiDi has spent $1.26B to buy back around 6% of its outstanding shares, with the majority of repurchases occurring before June.

Overall, I’m quite pleased with DiDi’s performance so far, particularly in its China segment. I don’t see much reason to adjust the assumptions in my projections from my deep dive.

The author of this write-up owns shares in the companies mentioned and may purchase or sell shares without notice. This write-up represents only the author’s personal opinions and is not a recommendation to buy or sell a security. No information presented in the write-up is designed to be timely and accurate and should be used only for informational purposes. Readers of the write-up should perform their own due diligence before making investment decisions.

Your original Didi writeup still needs to be found and read by more people. Great update.

Didi & Meituan to the CCP: “You can’t stop us from involuting in other countries!”